Tax Foundation@TaxFoundation

Sep 19, 2022

7 tweets

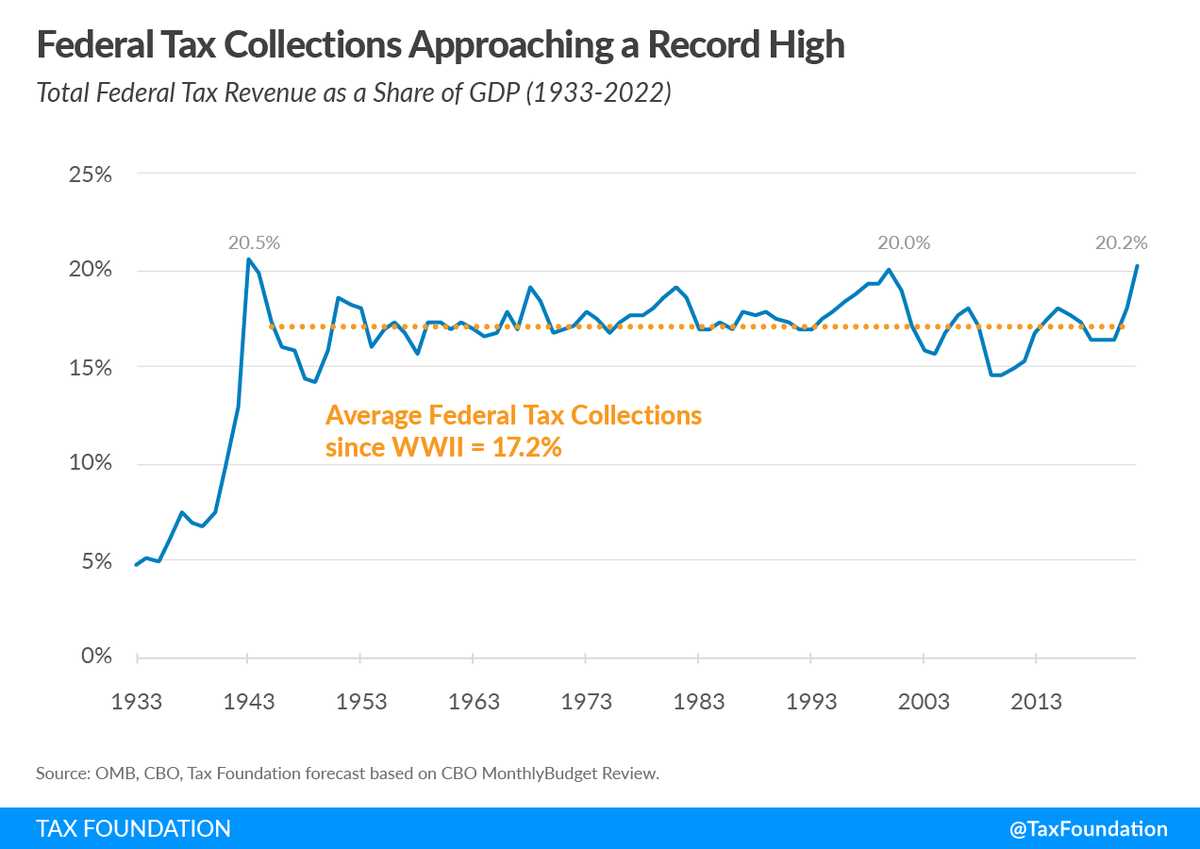

Federal tax collections are approaching an all-time high of 20.5 percent of GDP set in 1943 during World War II.

The latest inflation report confirms that prices for just about everything continue to rise, with the Consumer Price Index (CPI) up 8.3 percent over the last year and many categories up even higher, including food (11.4 percent) and energy (23.8 percent).

While not part of the CPI, another measure of inflation (call it the Taxpayer Price Index?) is also surging: federal tax collections are up 23 percent over the last year, according to the latest data from the Congressional Budget Office (CBO).

At the current pace, federal tax collections will reach a record high of about $5 trillion in nominal dollars for the fiscal year (FY) 2022 ending September 30, which is about $1 trillion more than last year’s $4 trillion in collections (also a record).

taxfoundation.org/federal-tax-co…

Policymakers should consider giving taxpayers a break, both in terms of taxes and spending.

Record federal tax collections on top of surging prices—essentially an additional inflation tax paid by everyone who uses dollars—should not be used as a justification for more spending.

Indeed, excessive spending in response to the pandemic is driving inflation, and rather than ramping up expensive relief programs (e.g., student loan forgiveness), we should be winding them down.

Taxpayers should demand that pandemic emergency spending end now that the pandemic emergency is over, and that their tax dollars be used more judiciously or returned to them.

Tax Foundation

@TaxFoundation

Data-driven tax policy research and analysis, guided by the 4 principles of sound tax policy: simplicity, transparency, neutrality, and stability.

Missing some tweets in this thread? Or failed to load images or videos? You can try to .