Frugal Sibusiso  @FrugalLocal

@FrugalLocal

Sep 23, 2022

17 tweets

Let's talk TAX AND RENTAL PROPERTIES!

How do you pay less tax on rental income?!

Thread below

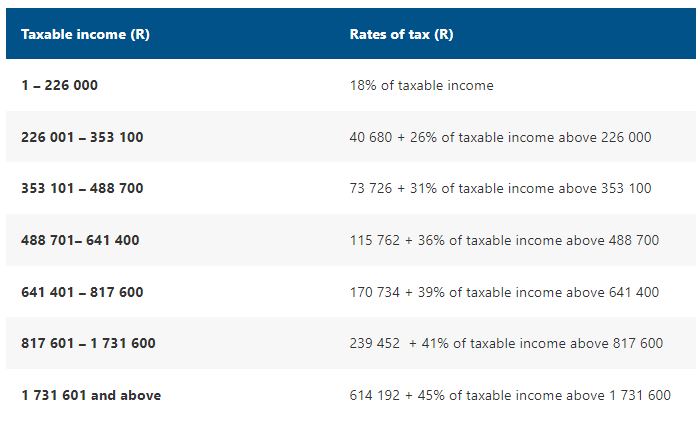

So, as you might know, rental income is taxed at your normal income tax rate. This means, if you're in the 36% bracket, you will be paying 36% income tax on all income made from property rentals.

But there has to be a way around it?

And that's what the rich and informed do ;)

You have a few choices in paying less tax in rental property:

1. More expenses and deductibles

1.1 Home loans

1.2 Betterment & Maintenance

2. less income

3. tax breaks.

4. do some funky entity dealings - not for the faint-hearted!

And a special section incl:

5. SELLING + taxes

1. More expenses - this means less taxable income. Every CENT you spend on your property SHOULD be declared to SARS. This include:

> Rental agency fees

> Levies, rates, taxes

> Maintenance (e.g. stoves, light replacements)

> Accounting system fees for self-managed units

Other deductibles include:

> Trips to your rental properties (petrol)

> Bond and transfer fees, admin charges

> Selling costs (but we'll get to that)

> Petrol for trustee/AGM meetings

1.1 But there is still income that's taxable? Well, this is why many opt for a bond. They leverage other people's money to buy the property for them. Ideally, you want the income to cover the bond, R&T and levies, but that's cashflow positive, meaning taxable.

1.1.1 - For less tax, you need a krugerrand property - strategically choosing a negative cashflow prop with the foreknowledge of an increase of value.

twitter.com/FrugalLocal/st…

Frugal Sibusiso  @FrugalLocal

@FrugalLocal

Jun 21 22

View on Twitter

THREAD on property investing - a page from my journey.

1) How do you identify a "good area"?

2) How do you know if a property offers good value?

3) How do you know if the condition of a given property is ok (e.g. you are not buying a money pit)?

1.1.2 So what do I deduct with a bond? The interest AND BANK FEES of your bond account are deductible from tax. You can phone your bank every year and get a tax certificate from them.

1.2 Betterment & Maintenance - Buying a new stove, putting in cornices, pool/garden maintenance and refurbishing are all tax deductible. Making your property better means higher selling prices // (possibly) higher rental.

And less tax payable :))

2. Less income - Rental income doesn't always escalate with 10% - this is an industry lie. However, you can still get property with the proper bond/leverage for almost nothing.

For me, my properties do increase above inflation in the long run. but please don't buy rubbish!

3. Tax breaks. So how does certain property groups pay +-10% dividends on their rental properties with a 28 % property tax? I believe this is done through Section13 SEX tax breaks.

twitter.com/FrugalLocal/st…

Frugal Sibusiso  @FrugalLocal

@FrugalLocal

Jun 23 20

View on Twitter

#5 Tax breaks are there to help you pay even less tax.

Some of these include Section 13 SEX, which is for 5> new or unused properties and FLISP, for lower-income households.

Make sure you understand the ins and outs of the tax break!

3.1 S13sex tax breaks is basically: own 5+ new or unused properties and get 50-100% of your property value back in tax breaks over 20 years. Please note the tax clawbacks if you sell!

localmoney.co.za/how-to-use-sec…

4. Funky dealings: Please BE CAREFUL! Let's say you want to buy property cash. You can buy it in a company (owned by you or trust), and lend it money to buy a property. It needs to pay you back with interest.. making the overall tax liability at the moment less, but fees higher.

4.1 If you're getting to the point of scaling your prop portfolio, please speak to an expert and get proper legal and tax advice.

5. SELLING property + taxes: For long term investments, you will need to pay capital gains tax. There's no way around it. In short, only 40% of the capital gain will be taxed if you’re an individual, and 80% if it’s a company or trust selling the property.

5.1 For the full calc, check this link. If you want to minimise this, I suggest speaking to an expert.

ooba.co.za/resources/capi…

For more property related content, follow me, @Frugal Sibusiso 🇿🇦 - DMs always open :))

Frugal Sibusiso

@FrugalLocal

All about money, investment property and online business.

I started @LocalCodeSchool.

I code.

Call me Sbu!

Weekly blog post pinned.

Missing some tweets in this thread? Or failed to load images or videos? You can try to .