Crypto Engineer  @CryptosEngineer

@CryptosEngineer

Nov 24, 2022

26 tweets

Tokenomics 101

Very often, tokenomics is the difference between a good investment and a bad one.

Here is what you should know about it.

/THREAD

Tokenomics.

Many people talk about tokenomics, but only some people understand it.

Focusing only on demand or supply won’t help you. To evaluate project tokenomics, you must consider two parts of this equation and understand its dynamics.

/1

Price is the result of supply and demand:

Demand & Supply => Price

It is set by these forces and reflects everything investors collectively believe, hope for, and fear.

/2

Value is not equal to the price.

It is driven by fundamentals (cash flows, growth, and risks). These fundamentals are captured on the demand and supply side.

/3

Supply.

A supply tells us how many coins or tokens we have.

Supply = Inflation/vesting - buybacks - staking (locking)

For most projects, we have 3 different supplies, which we can find on sites like @CoinGecko

/4

Circulating supply - The number of circulating coins in the market that are tradeable by the public.

It is comparable to looking at shares readily available in the market (not held & locked by insiders and governments).

/5

Total supply - The number of coins that have already been created, minus any coins that have been burned/removed from circulation.

It is comparable to outstanding shares in the stock market.

/6

Max supply - The maximum number of coins coded to exist in the cryptocurrency's lifetime.

It is comparable to the stock market's maximum number of issuable shares.

/7

Circulating supply can be changed by the following:

Inflation and vesting – new tokens are created and are tradable after the vesting period. This is mostly used to compensate for different protocol personas like investors, project teams, or users.

/8

Buybacks – tokens can also be destroyed (similar to stock buybacks). This reduces outstanding project tokens or requires the team to first buy tokens from the market.

Staking or locking – some tokens can be withdrawn from the public market to be locked in the protocol

/9

The dynamic behind this equation is complex - we must analyze all factors for many projects.

The most important metric to analyze is selling pressure. It tells us how the circulating supply will change after X months, where X is our investment horizon.

/10

If we will have a higher circulating supply in the future, the demand side will have to compensate, maintain and finally increase its price.

Demand OR Supply

OR Supply => Price

=> Price Demand

Demand OR Supply

OR Supply => Price

=> Price /11

/11

OR Supply

OR Supply => Price

=> Price Demand

Demand OR Supply

OR Supply => Price

=> Price /11

/11These 3 tools below can help you calculate the circulating supply:

@Etherscan

@Unlocks Calendar

@VestLab

/12

Demand.

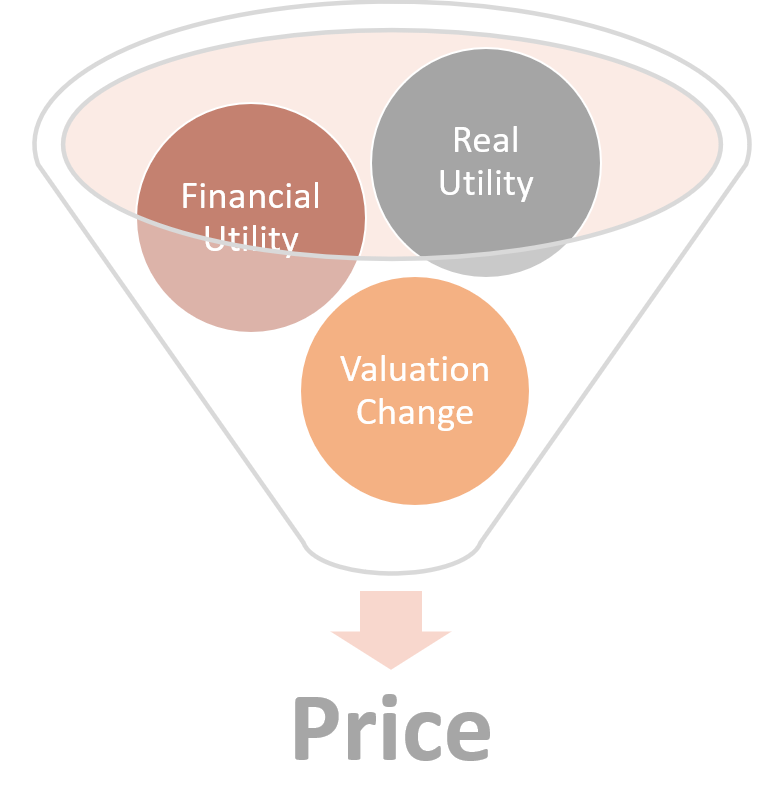

The demand can be divided into three forces:

Demand = Real Utility (Value) + Financial Utility (Earning on token/coin in Defi) + Valuation Changes (Speculation)

/13

Valuation Changes are impacted by the following:

Momentum (price action) – Most people (and some bots) buy if the price rises.

Investor mood – What is trendy now? Where is money flowing?

Other pricing factors – Accessibility for US citizens, CEX and DEX availability, etc.

/14

This is the most important factor in crypto's short and very often mid-terms.

As this market will be more mature, its impact will diminish. Master it if you are a trader.

twitter.com/CryptosEnginee…

/15

Crypto Engineer  @CryptosEngineer

@CryptosEngineer

May 02 22

View on Twitter

You Are Not Investor, You Are a Trader

Most people believe that they are investors because they are buying tokens. If you are only considering the price, mood and momentum you are a trader.

Check the main differences between Investors and Traders.

/THREAD

Financial Utility is the ability to earn on our tokens in #DeFi. 3 key parameters to consider:

Cash flow (APY) – How much will we earn in one year if nothing changes?

Growth of APY – How likely are these changes going to happen?

Risk – How can you lose money here?

/16

Real utility answers the question, “What value is provided by this protocol”?

For many projects, there is no value. Anyway, you can have a different investment strategy in which value doesn’t matter but only short-horizon price appreciation.

/17

To provide real utility, a project needs to have credible resources to deliver it. In most cases, we need the following:

• Teams and advisors

• Partnerships

• Investors, capital, and compliant product with regulators

/18

Specific requirements for them depend on our project’s operating model:

• Do we have enough resources (team, money, knowledge) to deliver this project?

• Do we have the required support from other companies and organizations?

• Do we believe that this is possible?

/19

Next, we need to understand how exactly we want to create value:

The market for which we can provide a solution to our problem (someone will have to buy our products or services)

Competitors which cannot provide what we want to offer – we need to be better in some way

/20

Now, we can evaluate the solution.

• Product/Service – how do we want to deliver value?

• Roadmap & Progress – when will this promise be fulfilled?

• Adoption & Community – who will benefit from this?

/21

I hope that this guide will help you better understand:

• demand forces,

• supply forces,

• price dynamics.

Let me know in the comments what you would like to learn more about.

/22

I you want to learn more about tokenomics, follow these accounts:

@Pothu

@hoeem (🌊, 🏴☠️)

@Aylo

@Route 2 FI

@Koroush AK

@shivsak

@kamikaz ΞTH 🦇🔊

@DeFi Made Here

@rektdiomedes

@Covduk

@misaka ʌı

@Ken Deeter ⚡️

@Gojo

@The Crypto Illuminati

@Taiki Maeda

@Sabo 🐉

@Barry Fried 🦇🔊

/23

@korpi

@Viktor DeFi 🛡🦇🔊

@Nick Drakon

@DΞFi Ξducator 🦇🔊

@pastry

@Stephen TCG | DeFi Dojo

more for alpha and #crypto tutorials.

/24

If you enjoyed this and want to learn more about investing, cryptocurrency & finance:

Follow me @Crypto Engineer 🚀 for more threads like this.

Follow me @Crypto Engineer 🚀 for more threads like this.

Check out some of my other threads:

twitter.com/CryptosEnginee…

/25

Check out some of my other threads:

twitter.com/CryptosEnginee…

/25

Follow me @Crypto Engineer 🚀 for more threads like this.

Follow me @Crypto Engineer 🚀 for more threads like this.

Check out some of my other threads:

twitter.com/CryptosEnginee…

/25

Check out some of my other threads:

twitter.com/CryptosEnginee…

/25

Crypto Engineer  @CryptosEngineer

@CryptosEngineer

Aug 20 22

View on Twitter

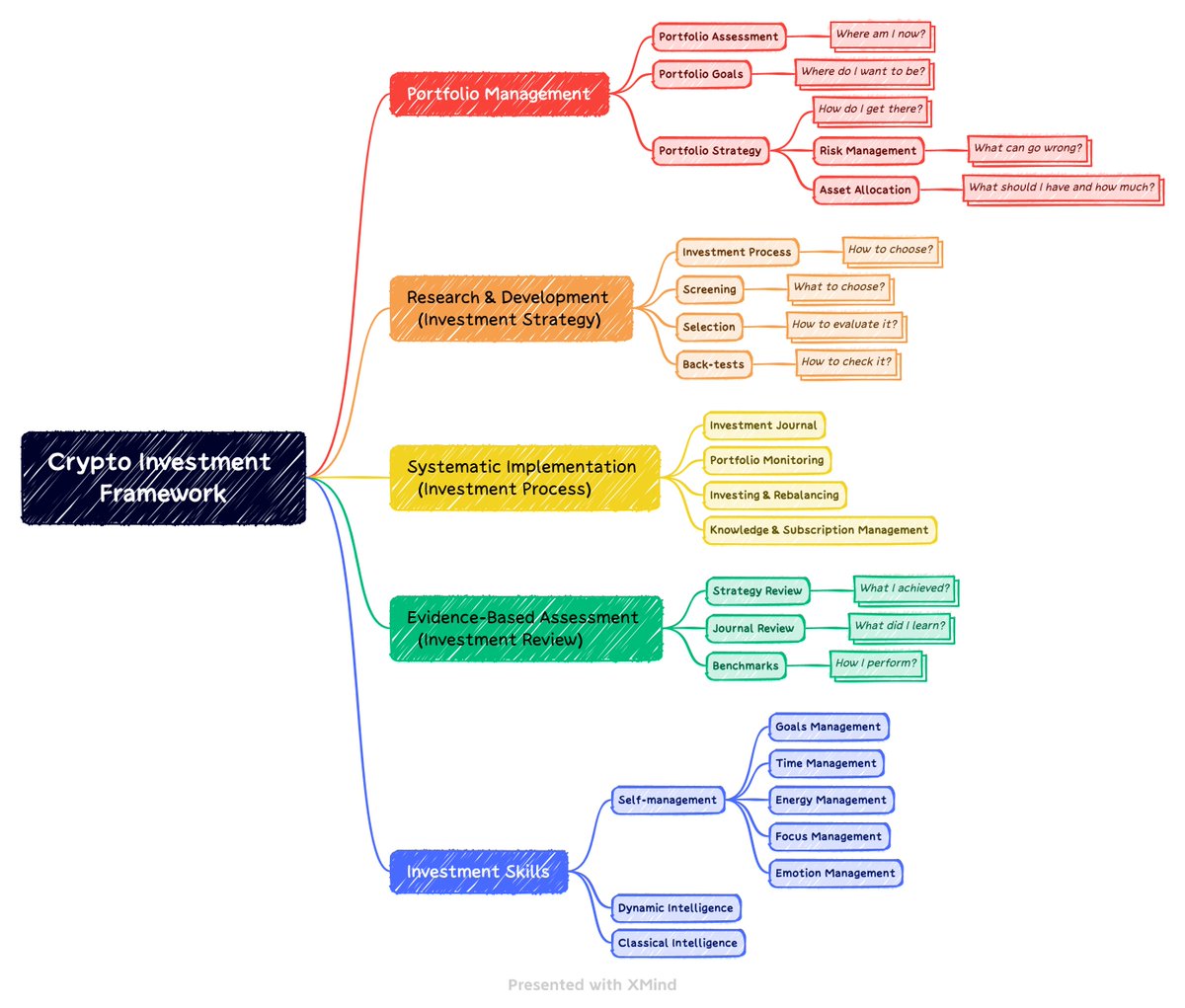

Cryptocurrency Investment Framework

Portfolio Management

Portfolio Management

Research and Development (Investment Strategy)

Research and Development (Investment Strategy)

Systematic Implementation (Investment Process)

Systematic Implementation (Investment Process)

Evidence-Based Assessment (Investment Review)

Evidence-Based Assessment (Investment Review)

Investment Skills

Check the FREE guide on:

cryptoengineer.notion.site

Investment Skills

Check the FREE guide on:

cryptoengineer.notion.site

Portfolio Management

Portfolio Management

Research and Development (Investment Strategy)

Research and Development (Investment Strategy)

Systematic Implementation (Investment Process)

Systematic Implementation (Investment Process)

Evidence-Based Assessment (Investment Review)

Evidence-Based Assessment (Investment Review)

Investment Skills

Check the FREE guide on:

cryptoengineer.notion.site

Investment Skills

Check the FREE guide on:

cryptoengineer.notion.site

Crypto Engineer

@CryptosEngineer

Engineer who deconstructs the crypto space into simple models🔬

Check Crypto Investment Framework: https://t.co/mdGkYj1raN

Missing some tweets in this thread? Or failed to load images or videos? You can try to .