Charles Edwards@caprioleio

Aug 3, 2022

15 tweets

The 12 Bitcoin Capitulations.

The raw count of evidence for major Bitcoin capitulation today is insane.

Each occurrence alone is a rare event and adds to the probability that forward risk-returns are skewed positively.

Let’s take a look at the 12 signs #Bitcoin capitulation:

(1) Supply transferred at a Loss (NEW METRIC).

The percentage of total supply transferred at a loss hit 1.9% last month. Historically, when this metric breaches 1.5% it demonstrates that a large portion of the market is in pain. Most were also great accumulation zones.

(2) BitFinex Whales are Dead.

BitFinex is known as the "home of whale traders", it has seen its Bitcoin perp Open Interest drop over 70% in the last 2 months.

BitFinex whales have been clinically wiped out.

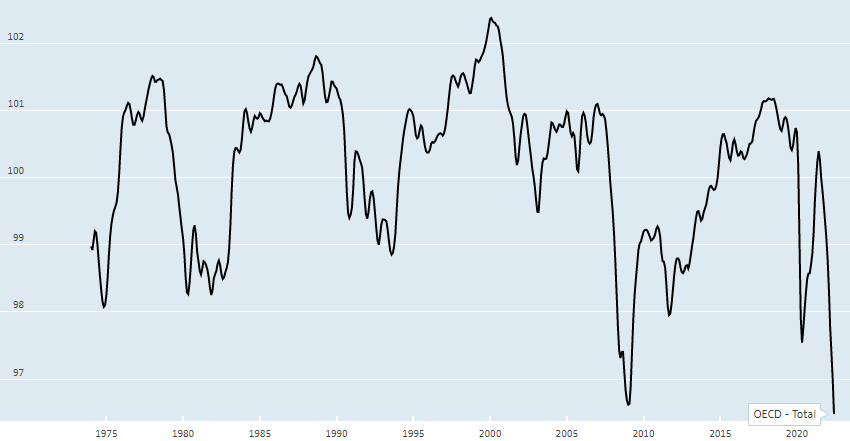

(3) Consumer Confidence (CCI) at an All Time Low.

CCI measures consumer sentiment, expected consumption and savings. CCI just hit an all time low.

Lower than the 2020 Corona Crash,

...lower than the 2008 GFC, and

...lower than the high inflation of the 1970s / 1980s!

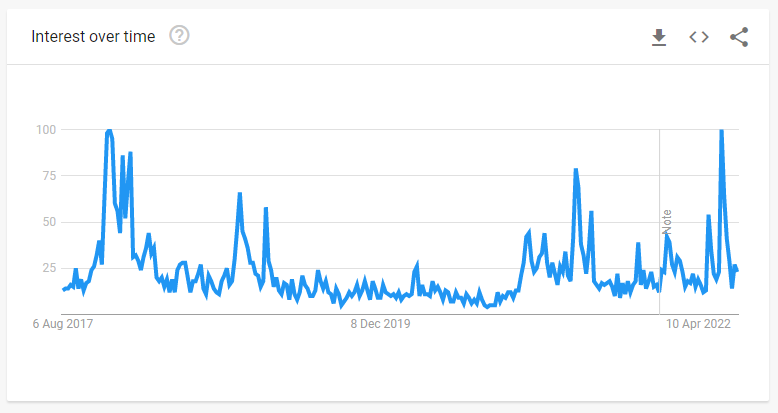

(4) Bitcoin is Dead.

Worldwide google searches for “Bitcoin dead” hit its highest level on record this June. This is another useful barometer for market sentiment.

Rothchild: "the time to buy is when there's blood in the streets"

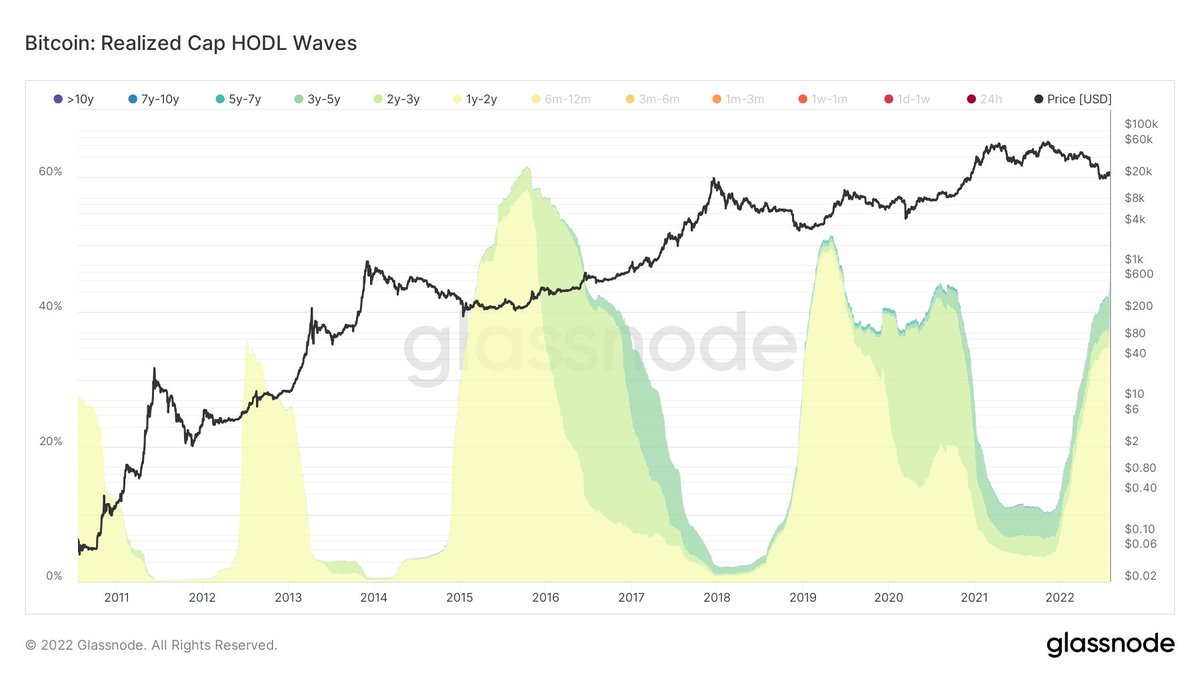

(5) Short-Term Holder Capitulation.

In November 2021, 90% of the market were short-term holders. ST holders have capitulated, and now represent just 58%.

A growing base of long-term holders has historically built out the base of the bear-market for the next bull-run.

(6) Hash Ribbon Miner Capitulation.

Our Hash Ribbon indicator shows that the current miner capitulation has been going for 55 days, and is set to breach the two month mark.

There have only been 3 other miner capitulations of longer duration than todays in Bitcoin history!

(7) The Worst Stock Market Real-Returns in 250 Years.

We have just seen the _worst_ inflation-adjusted downdraws in traditional markets in the last 8 generations.

Enough said.

twitter.com/caprioleio/sta

Charles Edwards@caprioleio

Jul 01 22

View on Twitter

This is epic.

2022 S&P500 real returns worst in 150 years!

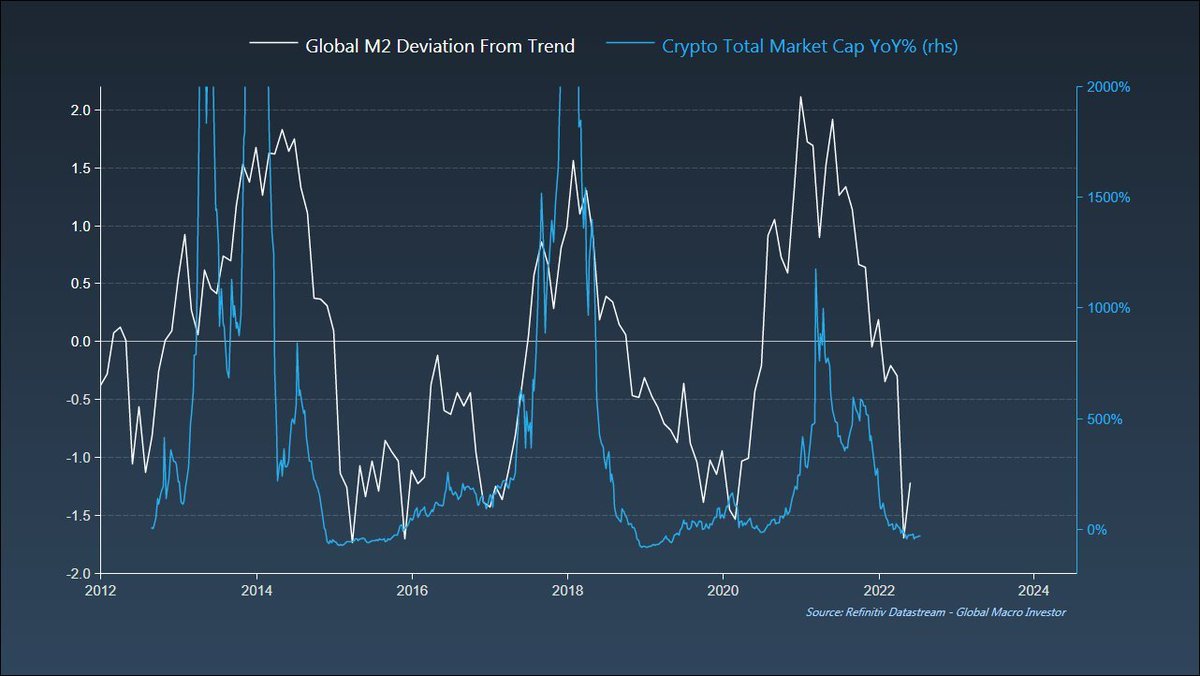

(8) Capitulation in Money Supply Growth.

The M2 growth rate is now approaching the lows of the last decade. A slowdown in the current rate of tightening from here would make sense.

As @Raoul Pal notes, manufacturing is a leading indicator and suggesting a turn is now occurring.

(9) On-chain Capitulation: DNTV

Dynamic Range NVT, Bitcoin’s “PE Ratio”, has capitulated to March 2020 lows.

Lower than the December 2018 Bitcoin low.

Look at the recent sharp up-tick. A sign of positive growth in a value region which can suggest a macro turning point.

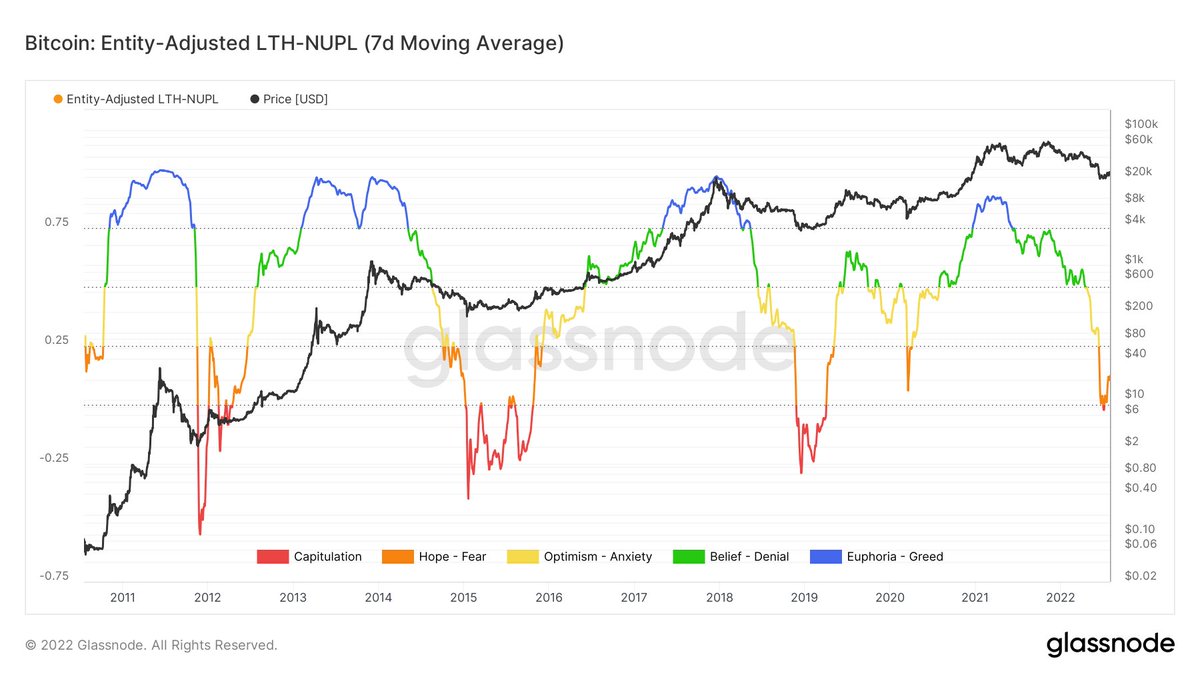

(10) More On-chain Capitulation: NUPL

Long-Term Holder Net Unrealized Profit and Loss (NUPL) has hit the reset button.

It briefly went into negative territory, suggesting a high ratio of losing positions in the market.

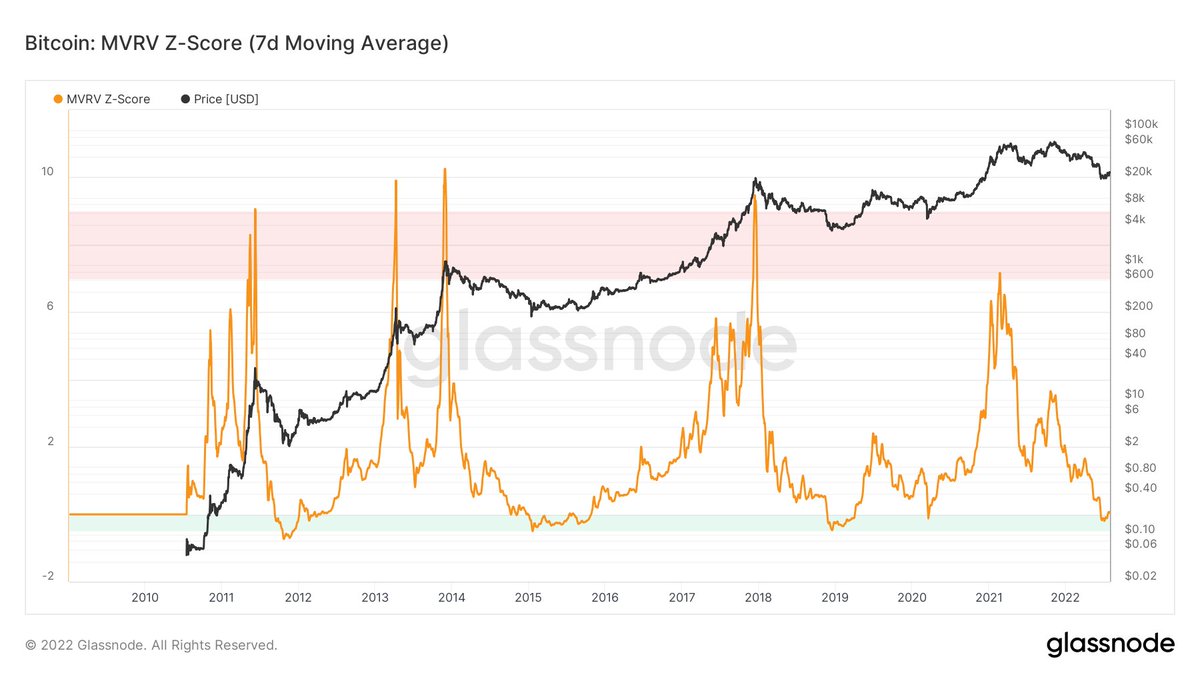

(11) Yet more on-chain capitulation: MVRV

Bitcoin’s Market Value to Realized Value (MVRV) entered the capitulation zone in June (the green zone on the chart below) but has now already started to recover.

#deepvalue

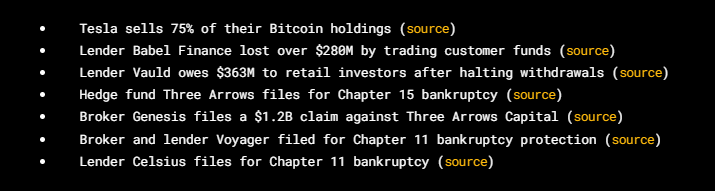

(12) The ultimate sign of capitulation: Bankruptcies

Take a look at the level of institutional capitulation here.

Leverage is one of the best indicators for relative over- and under-valuation in Bitcoin, and many major leveraged crypto institutions have been wiped out.

In the last 2 months, we have seen capitulation in many of the most important Bitcoin metrics and across many of the largest digital asset institutions.

Together these 12 capitulation metrics paint a picture of relative long-term opportunity.

Can you find more?

Read more in @Capriole Investments's free monthly newsletter delivered straight to your inbox:

twitter.com/capriole_fund/

Capriole Investments@capriole_fund

Jul 31 22

View on Twitter

MASS CAPITULATION

The raw count of evidence for capitulation today is immense. Each occurrence of these metrics is a rare event in itself. Together, they add to the increasing probability that we are in a high value Bitcoin accumulation zone.

More  capriole.com/capriole-newsl

capriole.com/capriole-newsl

capriole.com/capriole-newsl

capriole.com/capriole-newsl

Charles Edwards

@caprioleio

Sharing insights on Bitcoin and crypto. Founder @capriole_fund: #Bitcoin and digital asset quant algotrading fund. Not financial advice, do your own research.

Missing some tweets in this thread? Or failed to load images or videos? You can try to .