Joel Gascoigne@joelgascoigne

Sep 15, 2022

30 tweets

I love that our revenue dashboard (buffer.com/transparent-me) has led to a very interesting discussion here. A few things to note:

Transparency isn't a marketing strategy or tactic at Buffer. Transparency is a core value we've had for our entire existence.

Sam Parr@thesamparr

Sep 14 22

View on Twitter

Buffer has a dashboard where you can see all their revenue.

Pro: good marketing

Con: when things aren't going great, everyone knows

On that note, transparency goes far beyond this dashboard. Salaries are completely transparent (buffer.com/salaries), we have a transparent roadmap (trello.com/b/PDIV7XW3/buf), we have a map of the team (buffer.com/map) and a lot more: buffer.com/transparency.

And, internally, we are very open about everything. Bank balance, runway, current strategy, challenges, roadmaps for various areas, support metrics, you name it. Almost everything is shared, unless there's a very good reason not to.

Transparency breeds trust, that's a core belief and conviction we have, and we aim to follow it through entirely. It has built trust in the team, and with customers.

Transparency does have marketing benefits at times, because what we do is pretty unusual and that attracts interest. However, if transparency was a purely marketing tactic, it would be very hard to stick to it.

Therefore, if transparency was only for marketing benefits, the dashboard wouldn't still be up, especially in a time of decline.

Notably, we upgraded that dashboard a few weeks ago as a Build Week project (buffer.com/resources/buil), and added a ton more metrics we share publicly.

Now, let's talk a bit about our numbers. The past couple of years have been trying for us as a company, for sure. We hit a peak ARR of $22.3M in Jan 2020, and have been mostly flat or declining since then. Of course that's going to be really hard as a company.

Personally, I love that this is being discussed, dissected and debated in the replies to @Sam Parr's Tweet. That's one of the other benefits of transparency - we get some real smart people commenting and sharing ideas, giving advice.

A few things of note on our growth / decline situation:

It looks like our problems started in January 2020 (see this chart of ARR). However...

In reality, the issues actually started ~1.5 years earlier in June 2018, when we started seeing our number of paying customers decline.

At the time, we rationalized, even made it part of our strategy, that we were comfortable with number of customers declining, while we were growing revenue. This is a fairly typical play in many SaaS companies that hit $10-20m ARR. Going up market, finding larger customers.

And you can see here, the reason our ARR kept growing while customers was declining, was due to our ARPU (Average Revenue Per User/Customer) increasing during that timeframe:

In 2020, I realized that by allowing this scenario to play out, we were moving away from much of what has been our strength all along, and what is so baked in our DNA and culture.

We're not an enterprise SaaS company, we're all about small businesses and ambitious individuals.

So, I started some diligent, long-term, concerted efforts to not only turn revenue around, but do it the Buffer way, the way we've always grown. By serving customers and serving more of them over time. That meant, growing ARR while growing customers, with ARPU fairly stable.

As part of these efforts, we revamped our pricing to make it much more accessible to that individual starting out, and we doubled down on the free plan and freemium as our engine of growth, something we had made a few moves away from.

This happens to be during a pandemic, where small businesses were cutting many costs, and so we felt that impact too and you can see it in our numbers. However, this was a long-term choice and we stayed focused and committed to it. It didn't come without challenges.

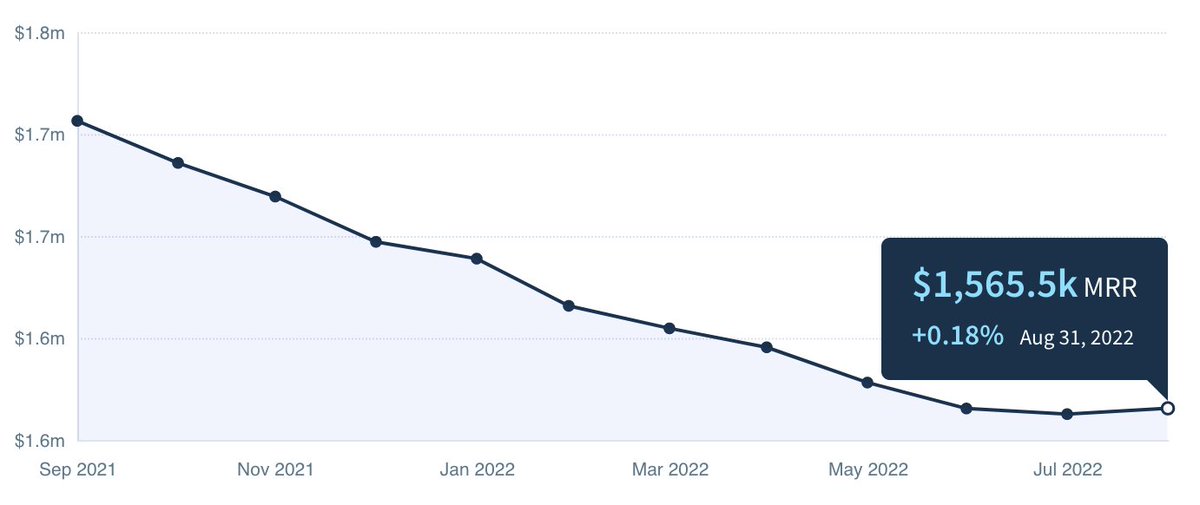

We're very much still in the thick of this chapter of our journey, this strategy. But, we did have a small win last month. We had our first growth month since we launched our new pricing and packaging:

Something that may be interesting to some folks, that isn't in our transparent metrics dashboard, is that we have two clear cohorts / segments currently. We have all the customers since we launched our new pricing and packaging, and the legacy customers prior to that point.

We haven't been too vocal about the change, and we haven't forced customers to migrate as the pricing model is so different that for some it is a significant increase (and for some a significant decrease).

However, the cohorts paint a story / picture:

Our legacy cohort has higher ARPU (average revenue per user/customer), whereas New Buffer (revamped pricing / packaging) has a lower ARPU as we doubled down on serving small businesses and individuals. This dynamic means we've been declining overall, but New Buffer is growing.

New Buffer is currently 34% of our revenue, whereas Legacy customers represent 66% of revenue. This is in the space of just over a year since we launched New Buffer (small business focus inherently means higher churn, so we see new customers take over fast).

Over time, we'll expect growth as New Buffer takes over as the dominant revenue cohort. But again, we're not going to push our legacy customers away if the previous pricing works better for them. We're here for the long-term.

That's all I'll share on our numbers, though as you can imagine there are so many layers to this and ways to segment / slice the data.

With that said, I think there are few elements of context about Buffer that are very important to make note of in a discussion like this:

Firstly, we've been around for almost 12 years. I don't believe any company exists for 12 years without going through some harder times, or at least dealing with significant market changes. In general, tech companies don't last that long, they sell or shut down well before then.

Secondly, we've raised just $4m in funding to be at our revenue levels. And we spent $3.3m buying out our main VC investors back in 2018. We did this through our profitability in 2017 and 2018. More here: buffer.com/resources/buyi

We've also been a distributed / remote company since the very beginning, for over a decade. And we've operated with a 4-day workweek for almost 2.5 years. I count what we've achieved as a significant success, given the environment we've created for ourselves, and our resources.

Our focus is on existing another decade, and figuring out how we can thrive long-term as an independent company. And share how we're doing (the successes and the failures) along the way.

At this stage, the company is majority owned by myself and the team, and we have a number of investors and alumni as shareholders who are largely excited and rooting for us on this long-term journey.

All of this affords us the ability to make very different choices to most tech companies. We can stay committed to small businesses, we can be generous with the team, we can make some really long-term decisions. This is something that brings me joy.

Thanks for reading! Just reply to this thread if you have any questions about our numbers, our journey, our culture, what we're trying to accomplish with Buffer, or anything else. Or read more here:

Culture blog: buffer.com/resources/open/

My personal site: joel.is

Joel Gascoigne

@joelgascoigne

Founder CEO of @Buffer. Building a long term, independent, profitable business with big ambitions, focused on value for customers and team.

Missing some tweets in this thread? Or failed to load images or videos? You can try to .