The Chartians@chartians

Sep 23, 2022

21 tweets

They say options trading can make YOU BANKRUPT - is it true ?

If yes then why ?

A thread on Risk management and Position sizing in options trading (worth 50k₹ course)

1/ Creating a view based on some analysis: It can be Technical/Chart, Option Chain or some Data analysis.

We have written a thread last week on what all the basic strategies you can use based on your view.

Checkout the thread here twitter.com/chartians/stat

twitter.com/chartians/stat

twitter.com/chartians/stat

twitter.com/chartians/stat

The Chartians@chartians

Sep 17 22

View on Twitter

Option trading is tough but here’s what can make it easier for you

8 option strategies that you can use in any market (sold as a ₹ 50,000 course !)

Now, after forming a view on a stock or index, don't directly jump to take the position.

Analyze the position first.

Some free tools that you can use are:

- Opstra

- @Sensibull - India's No:1 Options Trading Platform : Integrated with Broker

We will talk on how to analyze Nifty Option trades from option selling perspective and what all things to look at.

Same thing you can replicate for Stock or Banknifty as well.

2/ Analyzing the position:

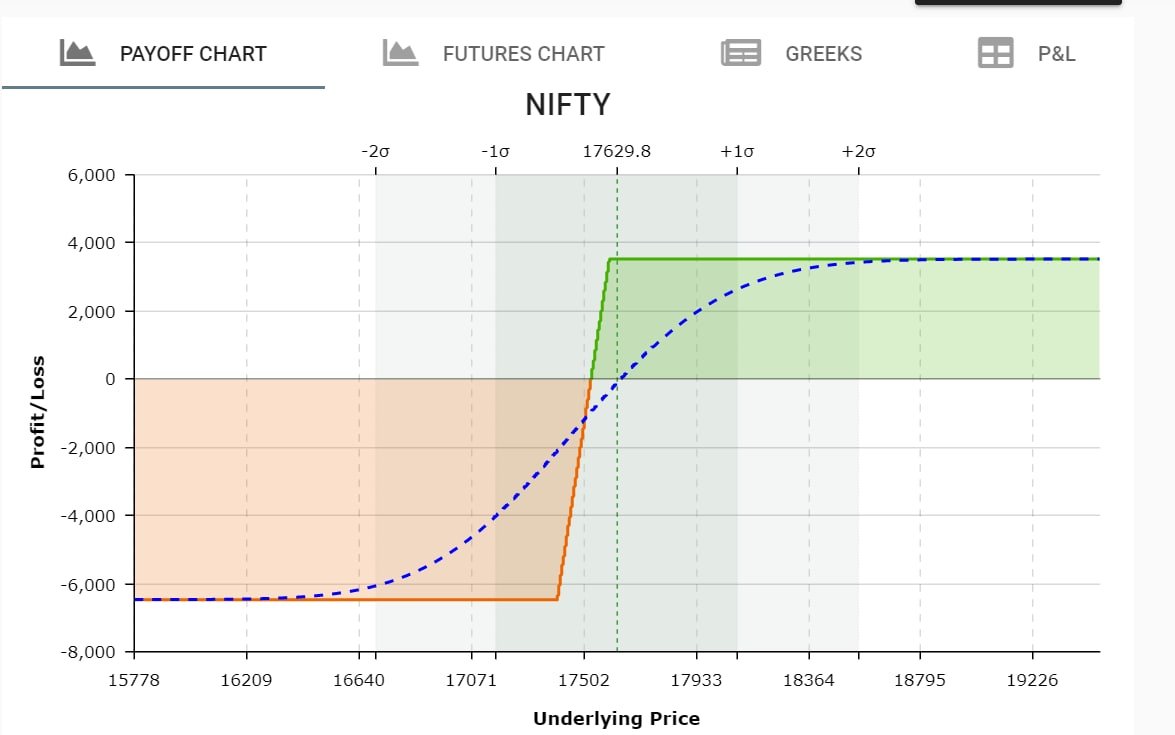

Let's say I am having bullish view on Nifty, then I can simply short Put Options and Hedge it as well so that margin requirement will reduce.

Let's assume Nifty is at 17620.

So I am looking to short 17600 PE and Buying 17400 PE.

Now, use Opstra Strategy Builder to analyse the position.

Link: opstra.definedge.com/strategy-build

Something like this will open on your browser.

So here you can select various expiry, Stock or Nifty/BankNifty Futures/Options.

So, I will simply add my position here in the Opstra which was 17600 PE sell and 17400 Buy as hedge.

After adding position, it gives some additional information about the position.

In this, most important is Max Loss. For current position, max loss is Rs 6,500 with one lot.

Other things are Probability of Profit, Max Profit, R:R ratio (this will not be favorable for option seller), Breakeven points and Margin Requirement.

Other than these, there is a graph which shows how payoff will look like on expiry(shaded part) and today (blue dotted line.)

If you are an option seller, then it's advisable to keep Stoploss at Breakeven levels or if the main option position becomes ATM.

Option buyers will get similar data if we check.

Let's assume the same view, Nifty is bullish.

So I will buy 17600 CE and Sell 17800 CE, or even I buy naked 17600 CE then let's see the data.

3/ Risk and Money Management:

This is the most important thing which option traders miss on.

You know how much is your max loss in any position based on the analysis.

So for any position, don't take more than 3% risk on your capital in any position.

There is a huge difference in Capital and Margin.

If you see 17600 PE sell and 17400 buy position then max loss is Rs 6,500 and Margin Requirement is Rs 28,000.

So my risk on margin would be 23% and this is incorrect.

So what is the correct way?

If your max loss is Rs 6,500 and considering this to be 3% risk on the capital, then your minimum capital should be around Rs 2 Lakh for this single position.

If you don't have high capital, then adjust your hedge leg so that risk minimize.

If you have Rs 1 Lakh capital to start with option trading then take Rs 3,000 risk on a single position, that's it.

With this, you will manage your risk, and you won't blow up your account.

One more hack here is if you have a certain capital, then you can take multiple option trades provided all the trades are based on different view.

So, if I think Nifty will go up hence took 17600 PE short.

But if I think the market will be sideways (17300-17900) range, then I can take an Iron Condor as well using same capital.

But this will work only if the view is different.

Now this same three steps can be replicated for BankNifty, Nifty, FinNifty, or any stocks Futures and Options.

Also, the same thing can be replicated on Sensibull. Zerodha user can follow these steps.

Create Basket Order and then click on analyze. Same data you will get.

Just to summarize this thread:

- Create a view (bullish/bearish/sideways).

- Plan your positions.

- Analyze it on the Opstra by adding all the trades.

- Check Max Loss.

- Limit it to max 3% of the total capital.

That's all on how you can analyze your option position before taking actual trades and do proper risk and money management.

If you find it helpful, then RT the first tweet.

Join our Telegram Channel for Stock and Option Trade and analysis  telegram.me/chartians

telegram.me/chartians

telegram.me/chartians

telegram.me/chartiansWe have an upcoming mentorship program of three months which starts from 1st October 2022.

In this we will teach what are cash and option trading setup that we use while taking any trades.

More Details twitter.com/chartians/stat

twitter.com/chartians/stat

twitter.com/chartians/stat

twitter.com/chartians/stat

The Chartians@chartians

Aug 29 22

View on Twitter

OUR LAST WEBINAR OF THE YEAR Basic details of course :

Basic details of course :

Our HERO-ZERO Stock Option Buying System

Our HERO-ZERO Stock Option Buying System

1 Prop desk intraday setup [Index]

1 Prop desk intraday setup [Index]

1 Index positional system

1 Index positional system

2 Cash based system

2 Cash based system

2 Cash based screeners

2 Cash based screeners

1 Automated risk management tool

1 Automated risk management tool

1 Live market FNO ticker

1 Live market FNO ticker

Basic details of course :

Basic details of course :

Our HERO-ZERO Stock Option Buying System

Our HERO-ZERO Stock Option Buying System

1 Prop desk intraday setup [Index]

1 Prop desk intraday setup [Index]

1 Index positional system

1 Index positional system

2 Cash based system

2 Cash based system

2 Cash based screeners

2 Cash based screeners

1 Automated risk management tool

1 Automated risk management tool

1 Live market FNO ticker

1 Live market FNO ticker No more Excuses now!

One Click and See your Trading Journal  This product we believe can help you immensely, at least if not making you a profitable trader it can tell you WHY you are going wrong, WHERE you are going wrong and WHEN you are going wrong.

twitter.com/chartians/stat

This product we believe can help you immensely, at least if not making you a profitable trader it can tell you WHY you are going wrong, WHERE you are going wrong and WHEN you are going wrong.

twitter.com/chartians/stat

This product we believe can help you immensely, at least if not making you a profitable trader it can tell you WHY you are going wrong, WHERE you are going wrong and WHEN you are going wrong.

twitter.com/chartians/stat

This product we believe can help you immensely, at least if not making you a profitable trader it can tell you WHY you are going wrong, WHERE you are going wrong and WHEN you are going wrong.

twitter.com/chartians/stat

The Chartians@chartians

Sep 07 22

View on Twitter

Journaling your trades is a pretty tough & boring task, but this software makes it easier in just one click !

More about @anastrat:

An AI powered Trade Journal for Indian Brokers that can change your trading forever

The Chartians

@chartians

Bunch of Passionate Chartists and traders on a Mission to Simplify Technical Analysis. Cleanest Charts in the Market⚡️

🕸️https://t.co/9fdfTWosRW

Missing some tweets in this thread? Or failed to load images or videos? You can try to .