Long-Term, Long-Only, Unleveraged, Low Turnover

Turtle (passive multi-asset ow/ bonds), Monkey (passive multi-asset ow/ equities) & Fox (active asset allocation) with 9th Nov2021 100% cash allocation (USD) for this inflationary bear market where both bonds and equities fall L-T.

Yearly Returns: Turtle Monkey Fox vs $SPX

Two Years of losses: 2018: -1.79% & 2008 -0.1%

Turtle Monkey Fox vs $SPX

(Jan 1998 to October 2022)

twitter.com/WifeyAlpha/sta

Wifey  @WifeyAlpha

@WifeyAlpha

Oct 21 22

View on Twitter

Lower your drawdown then focus on lower the portfolio turnover. High Sharpe / Sortino ratios are easier on higher frequencies but you can trade less size. You need low frequency / low turnover if you want to trade larger but you want high risk adjusted return stats / ratios.

50% Passive & 50% Active Portfolios

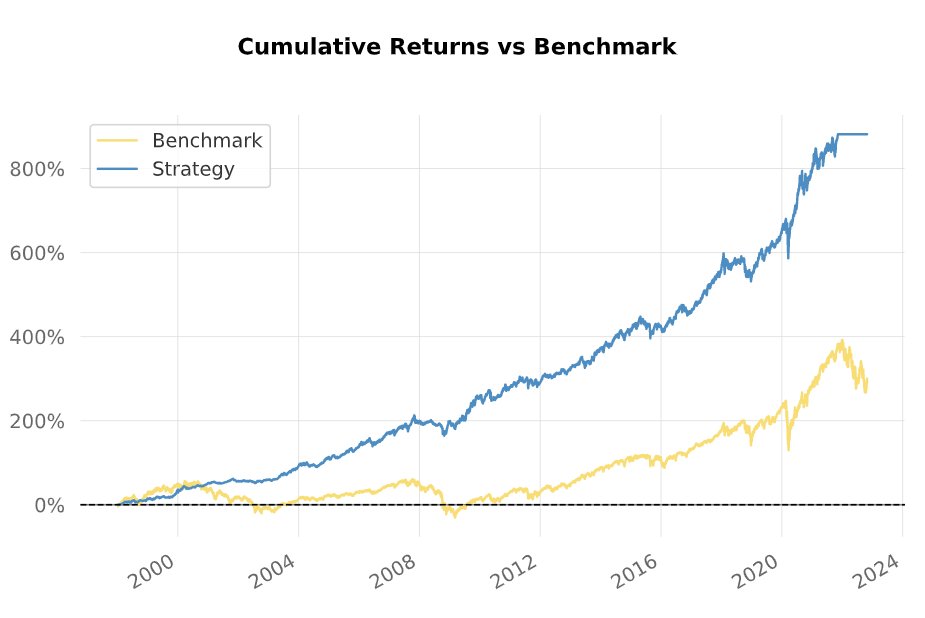

Turtle Monkey Fox vs $SPX

(Jan 1998 to October 2022)

Turtle Monkey Fox vs $SPX

twitter.com/WifeyAlpha/sta

Wifey  @WifeyAlpha

@WifeyAlpha

Oct 03 22

View on Twitter

Investors want you to produce high returns for minimal risk while not trading much. No pressure, mate!

Anyone can have a high Sharpe or Sortino ratio at a point in time. It is all about ratio consistency and doing it with a low portfolio turnover so you can scale and trade size.

Daily losses are capped at < -300 bps and the beta is dynamic with an average beta of 0.3 over the last 24 years. The program is positioned like this to take advantage of long-term positive drift in equity markets. This is a long-term program.

Long-Term Wifey Trading Systems

Turtle Monkey Fox Portfolios

50% Passive 50% Active Portfolios

(macro - boar not included)

Long-Term Wifey Monthly Returns Heatmap

This recession will be the biggest one of our lives. This is an inflationary bear market with a deflationary depression at the end. I have been ready and the programs have traded smoothly through it. We are prepped for the turn, whether that is in quarter or years. We are ready!

Turtle Monkey Fox vs $SPX

(last 24 years of data)

Yearly Returns vs $SPX from 1998 to 2022

Wifey

@WifeyAlpha

CQ/Wifey/VolQ || No Advice, Telegram or Apps || @RealAlphaWifey @VolatilityQ || Family Values || 9th Nov 2021 || Systematic Portfolio Management

Missing some tweets in this thread? Or failed to load images or videos? You can try to .