One Bubble to Rule Them All@shortl2021

Nov 23, 2022

6 tweets

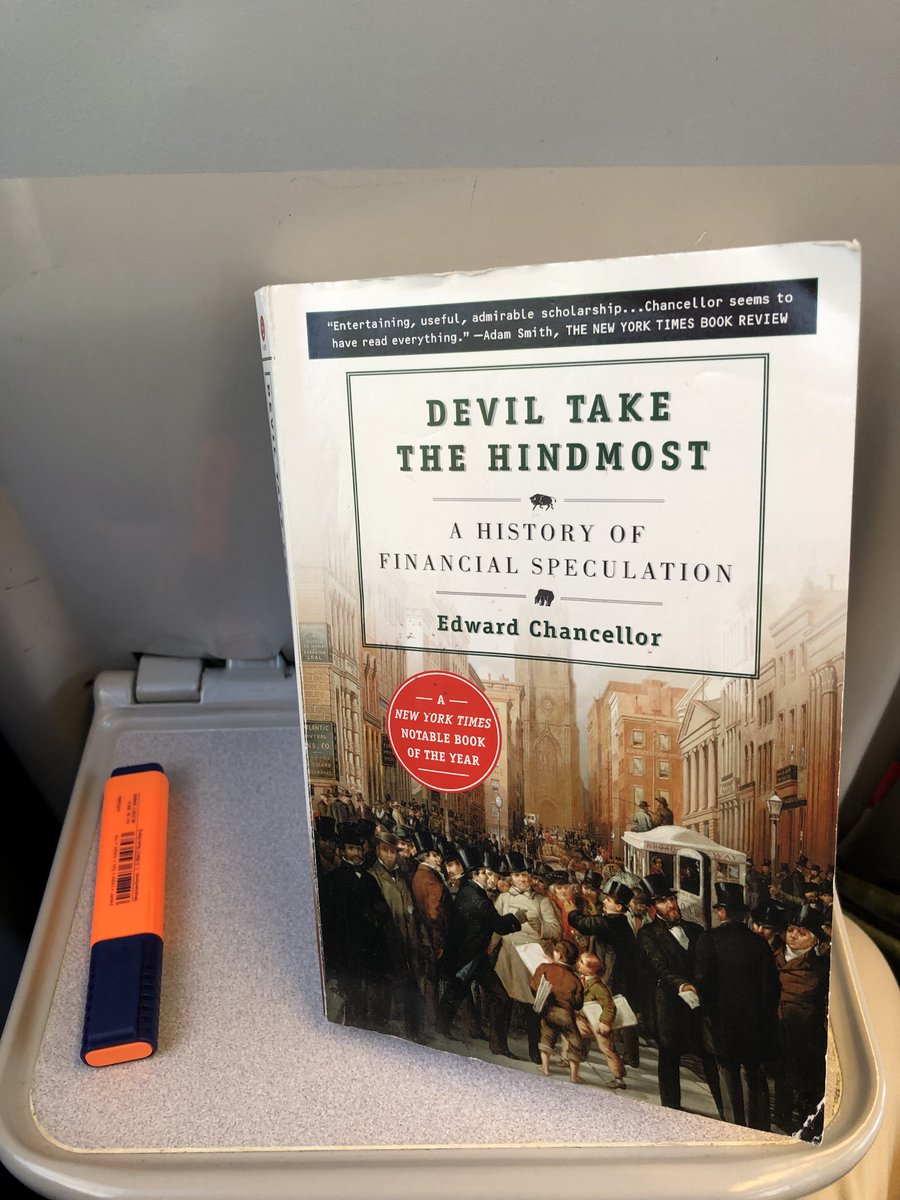

1/6. I don't think I have ever tweeted on a book footnote before. But while on the train into London, I was re-reading "Devil Take the Hindmost" to refresh my memory of the South Sea Bubble dynamic when one footnote jumped out at me.

2/6. Chancellor starts by looking at John Law's epic Mississippi Company pyramid scheme in 18th century France, the forerunner of the South Sea Bubble. The footnote:

"Law's great error was his confusion of shares with money.....

3/6. ".....Since rising share prices led to the printing of more money, which in turn was ploughed back into shares, there was no limit to the ensuing asset inflation...."

4/6. ".....The same circularity existed during the Japanese "bubble economy" of the 1980s when rising asset prices caused Japanese banks' capital to rise, allowing them to make more loans...."

5/6. "....Most pronounced in these two cases, this circularity is always present in modern financial systems where credit creation is dependent on asset values."

6/6. In our case, of course, it has been Ben Bernanke (with a bit of help from his predecessor and successors) who played the John Law character with relish, stoking up the price of financial assets, and thus creating a bubble circularity that fed upon itself.

One Bubble to Rule Them All

@shortl2021

CFA, veteran former hedge fund manager, analyst, economist. Back to trade "everything" bubble. Sister site @NRWLondon: EconTwit/FinTwit/HistTwit walking London.

Missing some tweets in this thread? Or failed to load images or videos? You can try to .