Florian Kronawitter@fkronawitter1

Nov 24, 2022

7 tweets

1- #ConnectingTheDots Commodities/Oil & Gas

We are currently in the ~4th inning of an economic slowdown

2- Many lead indicators point to significant contraction ahead

h/t @Kantro

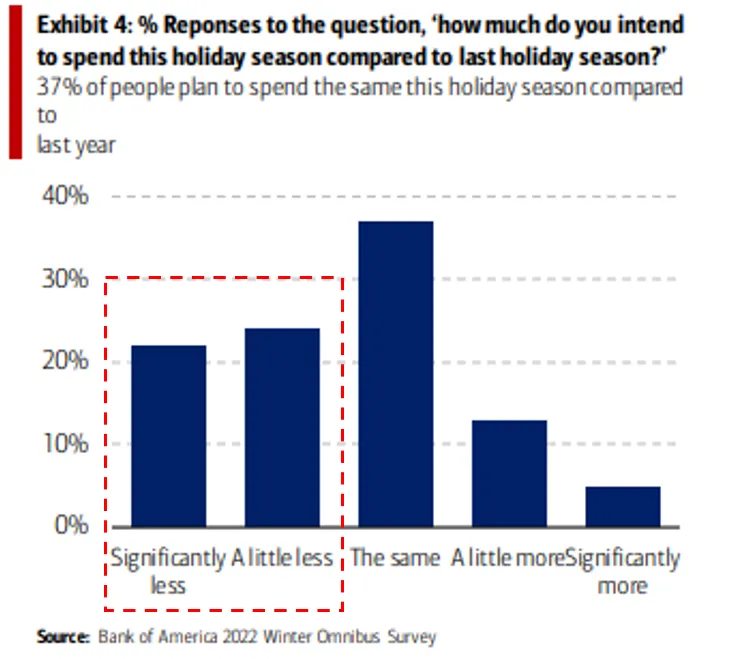

3- The world economy's last bastion, the US Consumer, shows signs of weakness

This is likely driven by lower income groups who used up their savings

4- In China, Covid will suffocate economic activity for most of the winter

We are at the beginning of a big wave that likely peaks in 4-6 weeks

Chinese mobility very likely declines from here

5- Meanwhile, the market perceives US monetary policy to have softened

This lead to a sell off in the US Dollar and US Treasuries that seems to near its end

J Powell speaks on the 30th November, what do you think he'll say?

brookings.edu/events/federal

6- Oil & Gas and commodities may be secular winners over the next 5-10 years, but they remain highly cyclical industries

Recently, they diverged significantly from their underlying cyclical trends

7- $XLE $XME $SXPP are well-owned with many "believers". This creates downside risk as economic realities set in

Short term, I see much downside for these sectors

End.

Florian Kronawitter

@fkronawitter1

Founder @SophiaKnowledge | Previously Merrill Lynch, Paulson, White Square (Founder) | All views my own, not investment advice

Missing some tweets in this thread? Or failed to load images or videos? You can try to .