Ignas | DeFi@DefiIgnas

Feb 21, 2023

22 tweets

1/ Stock indexes account for 18% of the TradFi equity market.

For crypto on-chain indexes it's only 0.007%.

Yet the moment for on-chain indexes to shine might come sooner than you think.

Here's why:

2/ Last week, crypto index platform Alongside raised $11M, led by a16z.

DeFi projects typically only raise between $1M - $4M USD.

And its flagship Crypto Market Index ($AMKT) has just 341 holders.

VCs are usually forward-thinking; I don't want to miss out

3/ W. Buffet said that by periodically investing in an index fund, the know-nothing investor can out-perform most investment professionals.

But it's still early for on-chain indexes, and most know-it-all crypto natives believe they can manage their own positions better.

4/ Currently, ETH or BTC are the market benchmarks.

To prove their worth, on-chain indexes need to outperform them.

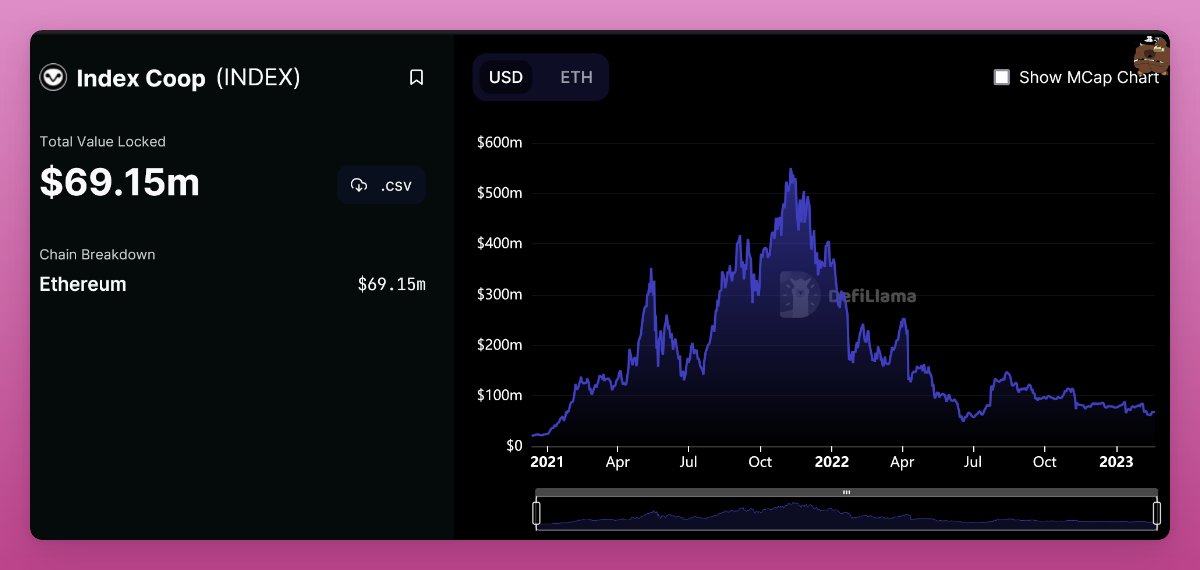

However, the largest DeFi Index (DPI) developed by Index Coop has been lagging behind ETH.

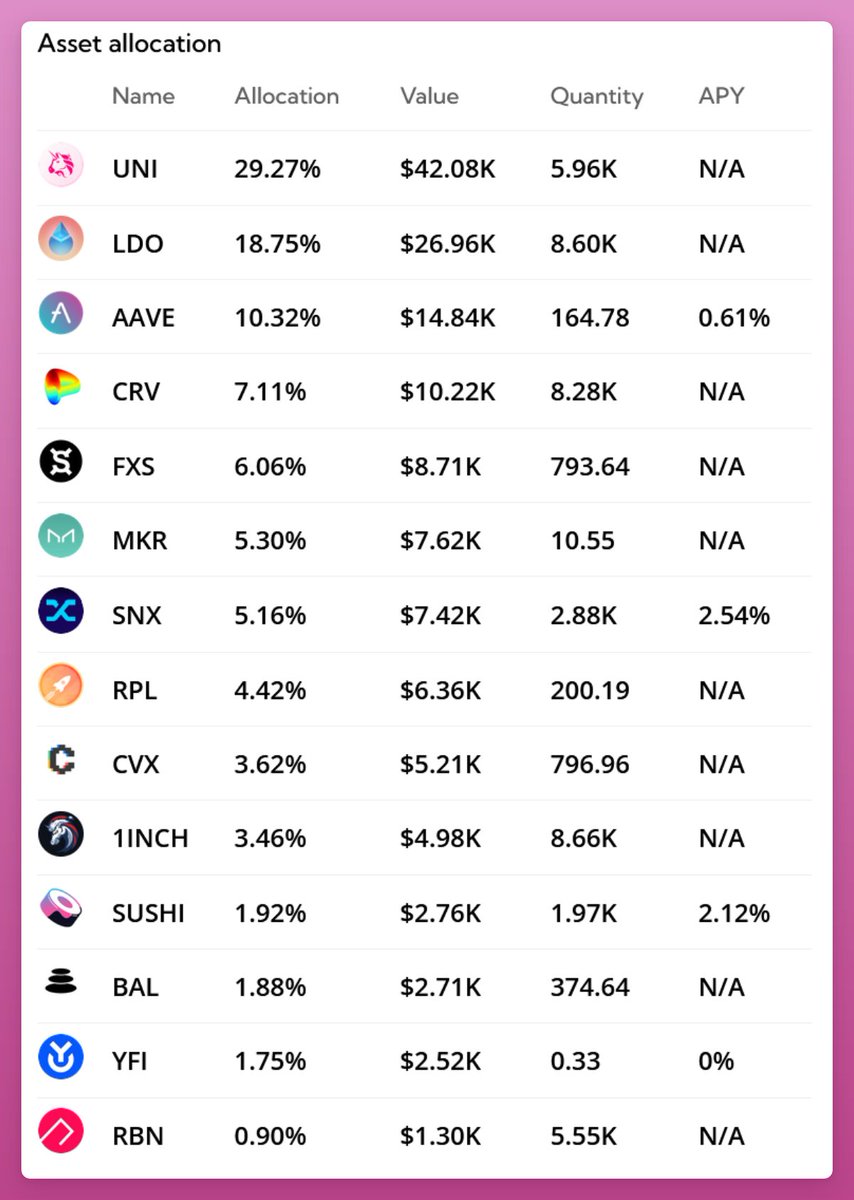

5/ $DPI found market fit during the #DeFi summer.

However, when the market pulled back, DPI and other indexes saw withdrawals.

People felt these were still risky, which was the main reason the capital moved out.

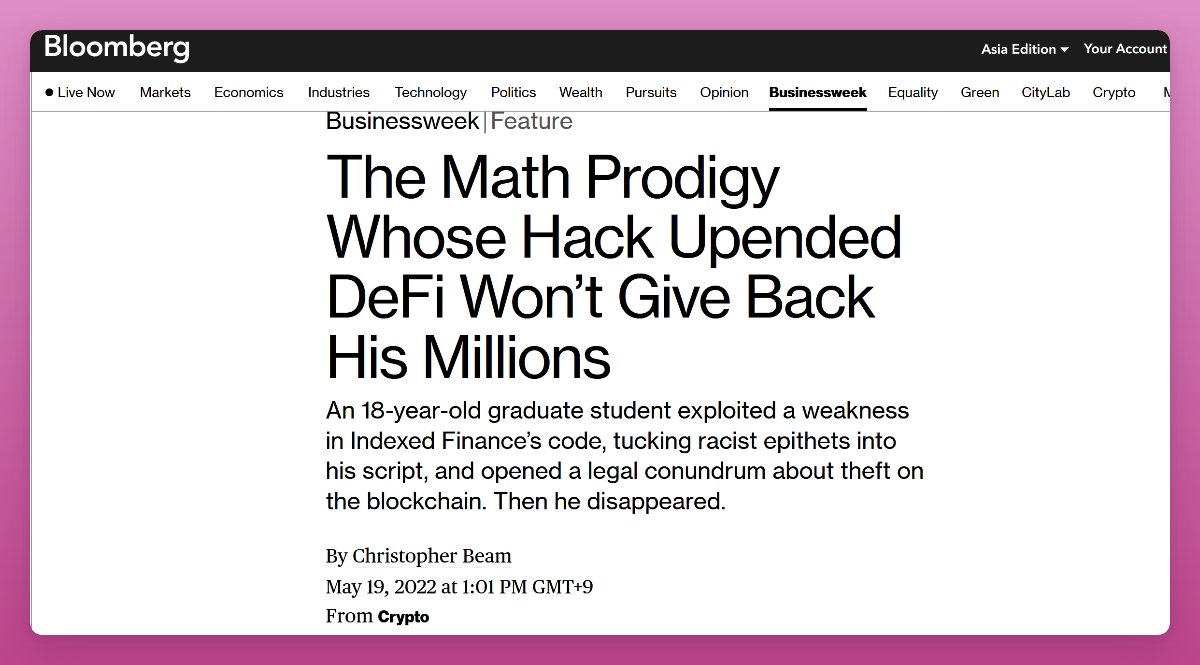

6/ For example, in October 2021, the Indexed Finance DEFI5 index was exploited for $18M USD.

The attacker exploited the way index pools were rebalanced, with an 18-year-old mathematician behind the hack.

So, with crypto correlation so high, holding ETH or BTC is also safer.

7/ But as mass adoption and market maturity sets in, crypto indexes are poised for growth.

The recent $11M Seed investment in Alongside makes me think the time for on-chain indexes is soon to come.

8/ "The goal is low-fee index products designed to enable total market exposure to crypto as a whole." - CEO of Alongside

The Alongside Crypto Market Index ($AMKT) is a basket of 25 assets, weighted by market cap.

It's a centralized solution with assets custodied by Coinbase.

9/ In traditional finance, indexes are mass capital allocators.

They follow a set of rules called a ‘methodology’ - often market cap weighted - adding or removing assets based on their market caps.

AMKT supports only 25 assets, since there's no liquidity depth for other assets.

10/ So, currently, major index builders are:

• Index Coop

• Alongside Finance

• Phuture Finance

• Indexed Finance

• PieDAO

The industry is still small: Total market cap is just $90.4M.

11/ BTW, you can read this thread on my blog with:

• More detailed explanations

• Extra section on their governance token performance

• Tokenomics

ignasdefi.substack.com/p/on-chain-ind

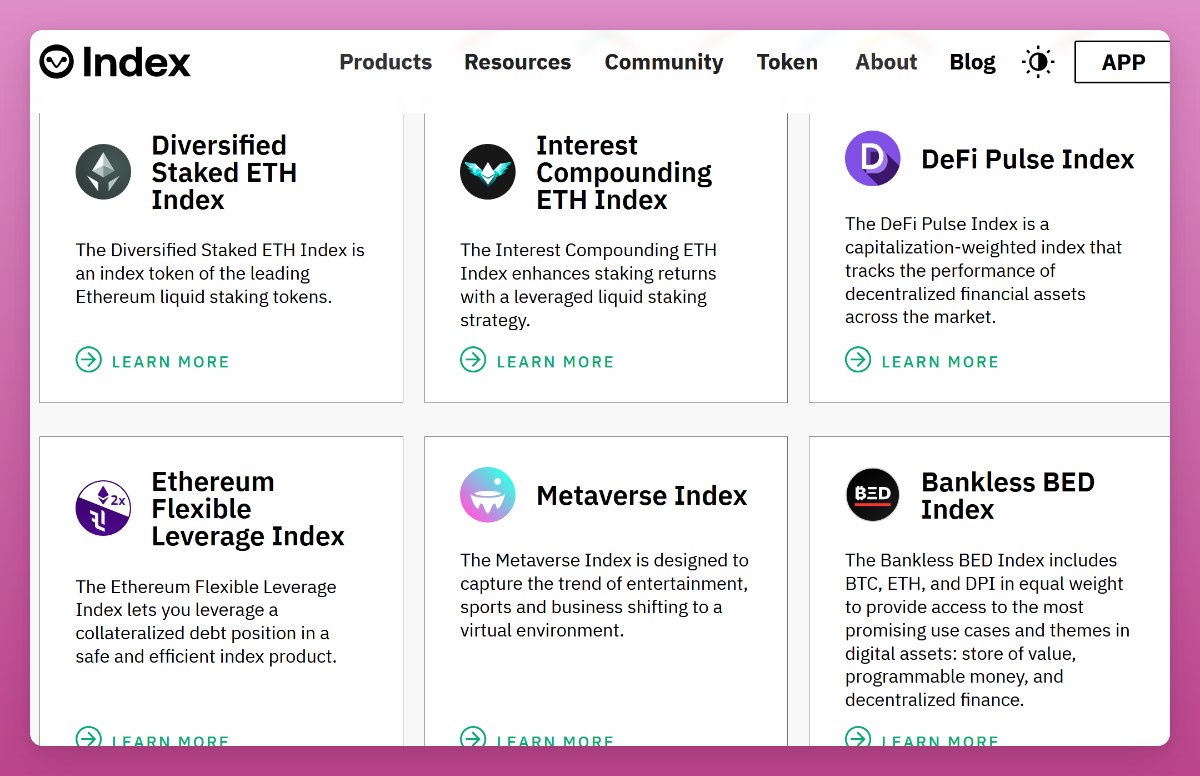

12/ Index Coop:

• DeFi Pulse Index (DPI)

• Metaverse Index (MVI)

• Bankless BED Index (BED) consisting of BTC, ETH and DPI

It seems they're prioritizing staking ETH services with the most of TVL being ETH liquid staking derivatives.

13/ Phuture Finance is different from Alongside as they offer non-custodial, on-chain and yield-generating products.

Those include:

• Phuture DeFi Index (PDI)

• Colony Avalanche Index (CAI)

• USDC Savings Vault (USV)

14/ The $PDI follows a market cap-weighted methodology, executing trades through @0x

It means you can execute large trade sizes because you are owning 100% of the assets within the mint.

Phuture has integrated with Yearn to allow for yield on certain assets.

15/ Indexed finance hasn't recovered from the attack.

Their last message on Twitter was 6 months ago. Medium blog and Discord are also silent.

What's left from the hack is currently available to withdraw – surprisingly, $1.3M still sits in their smart contracts.

16/ PieDAO was an early adopter of indexes, utilizing a Balancer pool architecture.

They've recently announced pivoting from a passive management to an active one, where 'holders administer DAO-owned funds with the mandate of generating yield.'

medium.com/piedao/the-aux

17/ The pivot is 'due to the fact that there’s limited market fit for Index products within the Crypto Ecosystem.'

Their index business was operating at a loss, so they moved to revenue-generating treasury farming operations through active governance.

Lesson: Timing is crucial.

18/ One of the drawbacks is that nearly all on-chain indexes can only manage a small amount of assets.

What happens when on-chain indexes have 30 assets? Or even more, like a proper TradeFi index?

The S&P 500 has 500 different assets!

19/ So, it's still early for crypto indexes.

It's one of my counter-narrative trades, because indexes make sense in TradFi and with market maturity they will pick up in crypto as well.

Current solutions only support ~30 tokens, but I want the S&P 500 of crypto.

Ignas | DeFi@DefiIgnas

Feb 07 23

View on Twitter

3/ Counter-narrative trading is like betting on Christians when the Roman Empire was polytheistic (belief in multiple gods or deities).

Or investing in Gen 1 Reddit Avatar NFTs when they were being mocked on Reddit and unknown on Crypto Twitter

20/ Diversified, sector-specific indexes would allow me to invest in new, growing sectors of crypto that I have no time to follow full-time.

I probably won't need a DeFi index, but Metaverse, AI, or NFT indexes are attractive to me.

They'd help me to save on gas fees as well.

21/ Yet their main goal is to outperform the market.

It requires indexes to include newer, high growth potential assets that don't correlate with BTC or ETH.

And doing it in a safe way is not as easy task.

22/ What would make YOU buy and index instead of ETH or BTC? Share your thoughts below  Follow me @Ignas | DeFi for more.

Like/Retweet the first tweet below if you can:

Follow me @Ignas | DeFi for more.

Like/Retweet the first tweet below if you can:

Follow me @Ignas | DeFi for more.

Like/Retweet the first tweet below if you can:

Follow me @Ignas | DeFi for more.

Like/Retweet the first tweet below if you can:

Ignas | DeFi@DefiIgnas

Feb 21 23

View on Twitter

1/ Stock indexes account for 18% of the TradFi equity market.

For crypto on-chain indexes it's only 0.007%.

Yet the moment for on-chain indexes to shine might come sooner than you think.

Here's why:

Ignas | DeFi

@DefiIgnas

Subscribe to my DeFi blog to get ahead of the curve 👉 https://t.co/7O0WAdXUnT

Co-founder of @PinkBrains_io DeFi Creator Studio

Missing some tweets in this thread? Or failed to load images or videos? You can try to .