Taimur Khan Jhagra@Jhagra

Mar 5, 2023

23 tweets

Why did IK highlight pensions as an issue we will solve? The issue in KP, costing Rs 107 bln this year, is only the tip of the iceberg. Pension costs across all Pak govts are Rs 1286 bln this year.

Simple reform could save more in a year than all of SS fake austerity measures.

Why did IK highlight pensions as an issue we will solve? The issue in KP, costing Rs 107 bln this year, is only the tip of the iceberg. Pension costs across all Pak govts are Rs 1286 bln this year.

Simple reform could save more in a year than all of SS fake austerity measures.

Why did IK highlight pensions as an issue we will solve? The issue in KP, costing Rs 107 bln this year, is only the tip of the iceberg. Pension costs across all Pak govts are Rs 1286 bln this year.

Simple reform could save more in a year than all of SS fake austerity measures.

Why did IK highlight pensions as an issue we will solve? The issue in KP, costing Rs 107 bln this year, is only the tip of the iceberg. Pension costs across all Pak govts are Rs 1286 bln this year.

Simple reform could save more in a year than all of SS fake austerity measures. 2. The cost of inertia is huge. In 2002-3 the national pension bill was around Rs 25 billion.

It is Rs 1286 bln today, an increase of over 50x in just 20 years.

3. Worse, given we know how many people retire every year, we know that without reforms, pensions growth will average between 22% & 25% per year for the next 40 years.

In just 10 years, pensions will cost Pakistan Rs 10,000 billion; 10x of what they do today.

Yet we don't act!

4. Pension costs are outgrowing receipts, by a significant margin. 20 years ago, pensions were 2% of budget expenditure. Today, they are 8%. And in 10 years, left unchecked, they will be 20% or more.

This is not a ticking time bomb. This volcano has burst!

5. Implication; without serious reform, as done by KP, the state will not be able to give you your pension within 5-10 years, maximum.

This process has started, as evidenced by the woes of 150000 Railways Employees, who have not been receiving regular pension since March.

6. Why this issue?

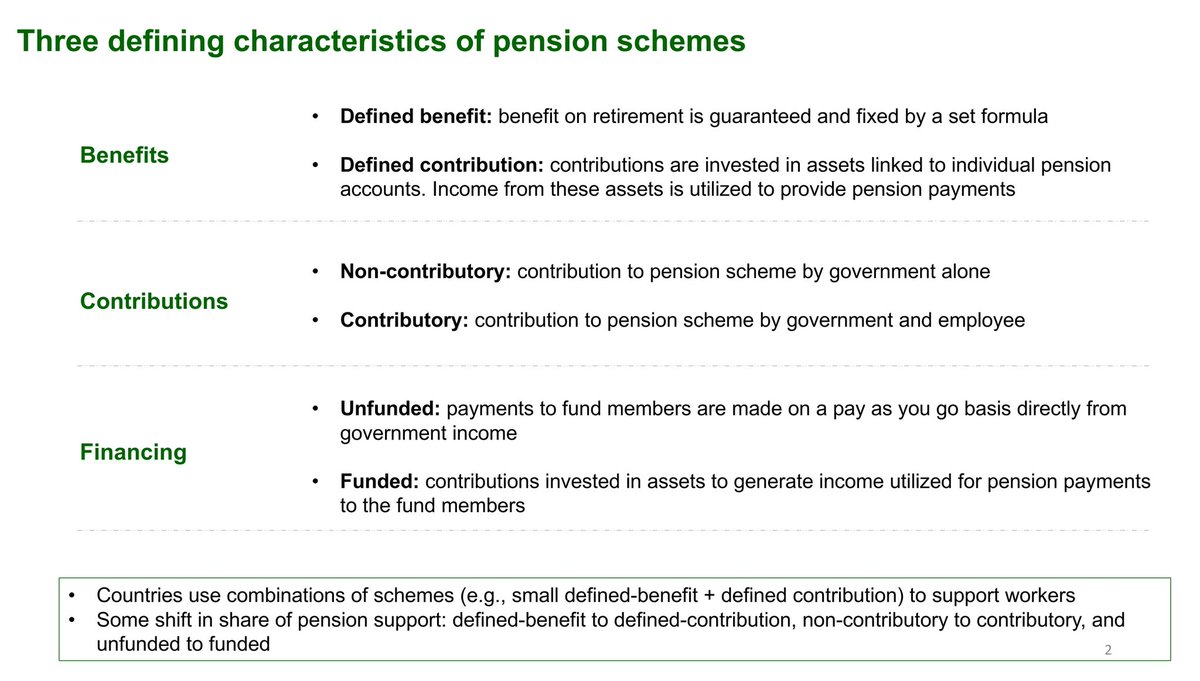

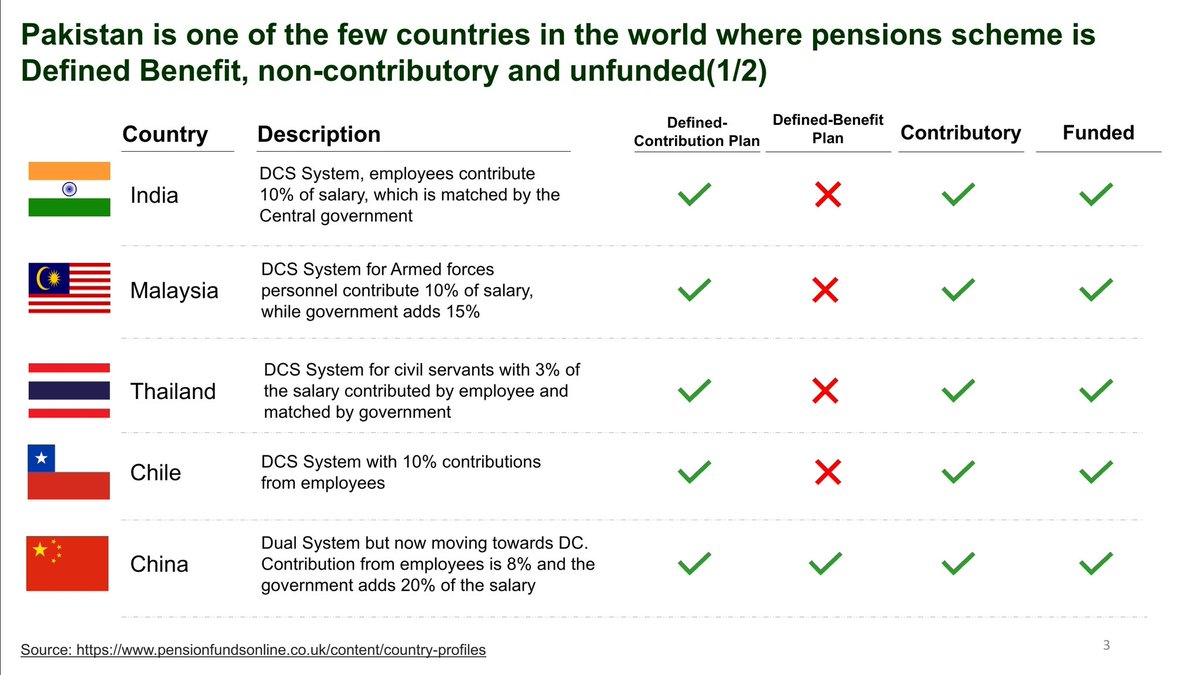

Pakistan is one of the few countries to still have an unfunded, Defined Benefit pension system.

Meaning, for every one of a million plus pensioners today, they don't contribute to their pensions, it is your taxes that finance the ballooning annual pension bill.

7. The cost of inertia is huge. India reformed its pension system in 2004.

If Pakistan had done the same, the problem would still be manageable.

8. This is why KP did not wait.

Over the last 4 years, we enacted some of the most ambitious and difficult pension reforms possible, including a move to a defined contribution pension programme for all new employees from July 1, 2022.

More detail to follow.

9. 13 tiers of pension entitlements in Pak!

1 Pensioner

2 Widow

3 Unmarried kids

4 Widow daughter

5 Wife of deceased son

6 Son of deceased son

7 Unmarried daughter of deceased son

8 Widow daughter of deceased son

9 Father

10 Mother

11 Brother

12 Unmarried sister

13 Widow sister

10. In KP, we rationalised this to cover only direct dependents and parents; so pensions do not continue in perpetuity for up to 60 or 70 years as they can in the rest of Pakistan.

11. Fascinatingly, individuals were allowed to draw two pensions at the same time. And active employees could draw both a salary and a pension.

These practices, prevalent in the rest of Pakistan, have been stopped in KP.

12. KP increased the minimum early retirement age from 45 to 55, also adopted by Punjab, saving Rs 15 bln per year.

In the current law, 5000 employees, mostly teachers, retired at 45, drew a pension for 15 years extra, and earned a second pay from the private sector.

13. The pension funds created by previous govts were a scam. They set aside taxpayer rather than employee finances to fund pensions. The pension bill outgrew the fund size within years.

In KP, we started the use of the profit on these available funds to offset pension payments.

14. Most important, from 1 July 2022, all new employees hired by the govt earn their pension through KP's new Defined Contribution pension programme, the first in the country. Employees pay 10%, govt pays 12%, and employees pensions are safeguarded.

15. The funds raised for the Defined Contribution pension programme have an added benefit. They become a source of investment in the future.

In just 10 years, KP's pension fund can have Rs 200 bln to invest.

16. There is more that can be done, starting with changing a few basics in the civil service:

a. Dismantle the Universal pay scales & align pay to market & vocation

b. Improve employee pay through monetising benefits such as housing & transportation & providing health insurance

17. (Cont)

c. A review of future hiring needs & the need for every govt hire to be a permanent employee.

Hiring on contract & outsourcing services not govt's core competence, is what will cause the most significant savings in pay & pensions, & allow for more competitive salaries.

18. Back to pensions; did you know that while the law says that pension to be 70% of last drawn basic pay, illegal notifications in Islamabad, followed by the provinces, allow new pensioners to pick up to 120% of basic pay as first drawn pension.

KP stopped this practice in 2022.

19. Also, the definition of last drawn basic pay is interesting.

Originally, defined as the average pay of an employee in the last 3 years of service; changed to be defined as the last pay drawn in the last month.

The change costs an additional 10% of the pension bill.

20. Given increasing life expectancy, it also makes sense to increase the retirement age.

KP tried this in 2019, but ultimately the DMG lobby prevailed and had it reversed. Sooner or later this will also need to be done along with a promotion system not linked to vacant posts.

21. Most important is the challenge of the unfinanced pensions of existing employees on the unfunded, defined benefit programme. How do we finance these in the next 40 years? Should only tax-payers pay for them? Or should the burden alo be on govt employees enjoying the benefit?

22. I believe these employees will need to contribute to a pay-as-you-go pension programme. Current employees help finance current pensions.

The contribution, out of their salary increment, can save the country Rs 150 bln this year.

23. Grade 17 and above executive officers in KP already do this, but it should be mandatory for all govt employees across Pakistan.

These aren't easy steps, but KP has done most of them. For a country in distress, we have no option but for all to contribute.

Taimur Khan Jhagra

@Jhagra

KP Finance Minister (Aug 18-Jan 23); KP Health Min (Feb 20-Jan 23); MPA (Jul 18-Jan 23); McKinsey (2008-18); LBS MBA (2006-08); Schlumberger (2000-06); GIKI 2k.

Missing some tweets in this thread? Or failed to load images or videos? You can try to .