Game of Trades@GameofTrades_

Mar 12, 2023

15 tweets

Recession fears have declined since June 2022

Is it justified?

Here's what the charts say

A

2/ Recession fears were at their highest when the market hit bottom

Since then, the markets have seen a powerful rally after the slight undercut in Oct 2022

3/ In 2008, we faced a similar situation with recession fears:

- Spiking between July 2007 and January 2008

- Declining between January 2008 and June 2008

4/ The spike in recession fears coincided with a market drawdown

But the decline coincided with the 2008 bull trap

5/ As weak economic data emerged at the start of the recession, fears of a new recession spiked again in June 2008, reaching a new high on Google Trends

The markets fell an additional 50% + during this period

6/ The economy is heading towards a recession again as unemployment rates have reached a historic low

Unemployment rates have consistently marked the end of an economic cycle since the 1950s

7/ Unemployment rate dropped to 3.4%, its lowest level since the 1960s

This suggests that the job market may be at the end of its cycle, which could be a warning sign for a market top

8/ If the market drops from here, retail may be caught off-guard

Retail money market ratio shows the retail cash position through the money market against the market cap of the S&P 500

Market top = retail money market ratio at low levels

9/ During a recession, retail money market ratio typically spikes above 9 as people shift from the stock market to cash in the money market

Prime examples include:

- 1982

- 1990

- 2001

- 2008

10/ Once the recession sets in, as signaled by the deep yield curve inversion, retail money market ratio could spike, leading to a stock market capitulation

This isn’t a timing tool, but there’s still plenty of room for the indicator to rise in case of economic weakness

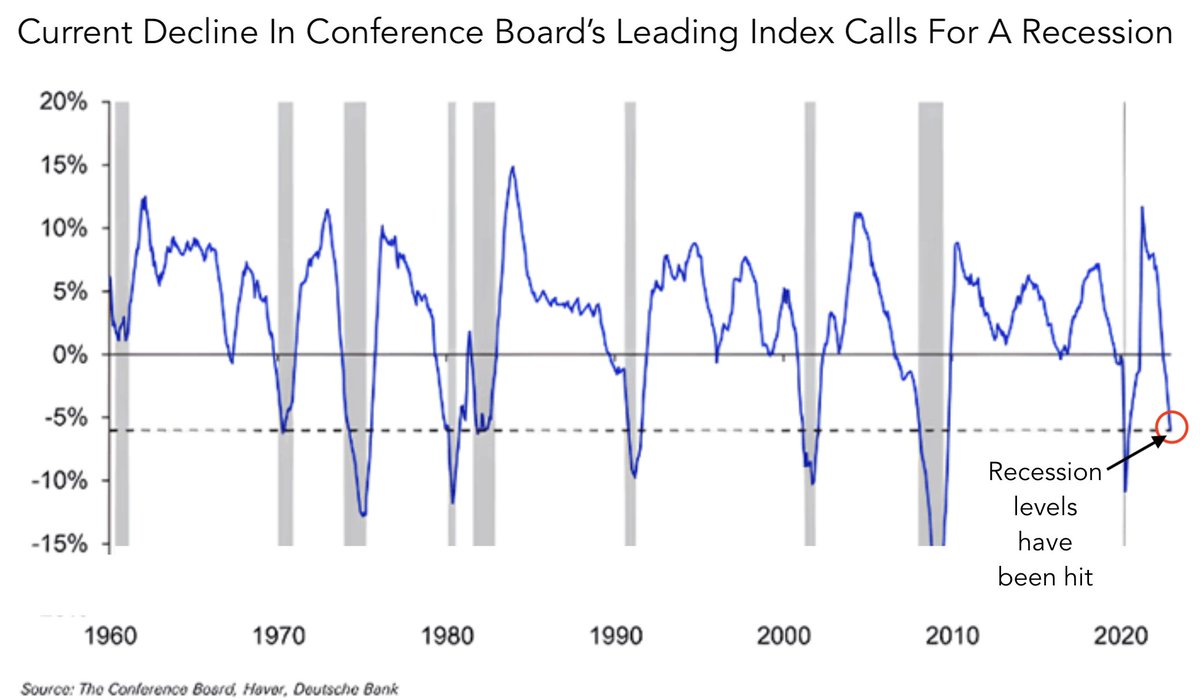

11/ Leading economic indicators strongly suggest a recession

With a track record of accuracy

12/ Leading economic indicators contract 1-1.5 years prior to real GDP contraction

And 6-12 months before a recession

Indicating that the worst is yet to come

13/ Recession looms and inflation is turning out to be stickier than most anticipated

Copper and ISM services business prices are very closely correlated

Copper suggests inflation pressures are not over yet

H/T @AndreasStenoLarsen

14/ Despite recession fears declining and a record low unemployment rate, the retail sector’s overexposure to equities indicates more pain ahead

Economic data such as the labor market, and a decline in leading economic indicators, suggest a looming recession

15/ Thanks for reading!

If you liked this, please like and retweThet the first tweet below.

And follow @Game of Trades for more market insights, finance and investment strategy content.

twitter.com/GameofTrades_/

Game of Trades@GameofTrades_

Mar 12 23

View on Twitter

Recession fears have declined since June 2022

Is it justified?

Here's what the charts say

A

Game of Trades

@GameofTrades_

Data-driven Investment Research | Follow to learn about #finance & the global #economy | 246k YT subs | Get a free trial at https://t.co/sHo7UJqsrF

Missing some tweets in this thread? Or failed to load images or videos? You can try to .