Massive announcement by the Fed and US policymakers.

The gist: all depositors of SVB and Signature Bank made whole, and a new facility to provide liquidity to banks under stress.

A short thread.

1/

"Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed"

Sorry equity investors, do your homework.

"Depositors will have access to all of their money starting Monday, March 13."

Uninsured depositors made whole.

2/

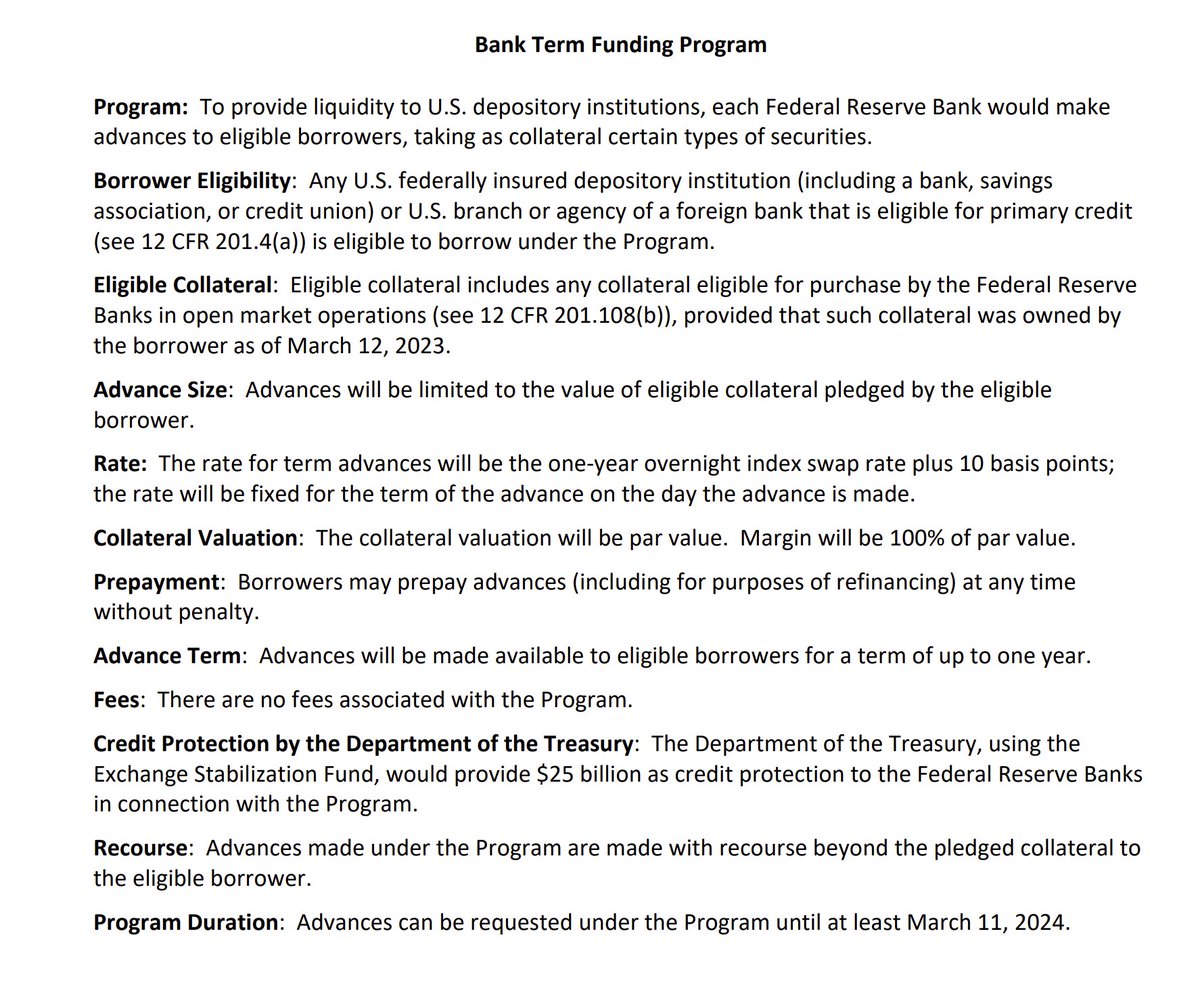

This is how the Fed intends to backstop other liquidity issues: a new facility called Bank Funding Term Program

The idea is to provide banks with an alternative to liquidate their bond holdings when in need of raising liquidity to meet deposit outflows

Two important points:

3/

Basically all HQLA bonds and not only Treasuries are eligible - banks can post them to the Fed to raise money.

And bonds will be valued at par (!), so all the negative mark-to-market from unhedged bonds is not considered with this facility.

What are the terms?

4/

Excellent, in my opinion.

Funding is at 1-year OIS (basically 1-year market-implied Fed Funds) plus a meagre 10 bps spread on top.

1 year guaranteed liquidity at Fed Funds plus 10 bps posting collateral deep in the mud but valued at par.

Quite the deal.

5/

Just some quick thoughts.

I was right on the package: no bailout for equity owners, uninsured depositors compensated as much as possible.

The new facility basically provides very reasonably priced funding to banks under stress if deposits go away.

Of course...

6/

...these banks were paying basically nothing for these deposits and if they must access the BFTP they will end up paying 4-5% for their funding now.

But that is still a much better proposition than going belly up in a regional bank run.

7/

Planning to release frequent and deeper updates on TheMacroCompass.substack.com over the next few days.

Consider paying a visit.

8/8

Alf

@MacroAlf

Founder & CEO of https://t.co/ERFOPNN11x: unique macro insights, interactive tools & portfolio strategy to step up your macro game. Former Head of $20bn Portfolio.

Missing some tweets in this thread? Or failed to load images or videos? You can try to .